The chemical carriers market in 2005

AT THE BEGINNING OF 2005 AND ESPECIALLY FOR LONG HAUL VOYAGES, THE UPWARD CYCLE OF FREIGHT RATES SEEN IN 2003 AND 2004 FOR CHEMICAL CARRIERS STARTED TO SLOW DOWN. This slackening pace marked the end of an euphoric period for owners, who profited for over 18 months from an excellent market. Previous periods of high rates have been shorter, and even if record levels were achieved the good times only lasted several months.

Freight rates on routes leaving the US witnessed a fairly steep decline in 2005 - though remained steady throughout the year. On most of the other long-dis-tance movements, this lower trend stabilised in the summer until the market picked up markedly in the last quarter.

Even more surprising, in the context of high freight rates, was that the demand for time-charters remained very firm and charter levels rose to unprecedented heights. For example a ship of 16,000 to 17,000 dwt with stainless steel tanks was being fixed for a one-year period at around $ 17,000 per day in the first quarter, then around $ 15,000 per day during the summer, to finish the year around $ 16,000 per day. In the meantime, equivalent time-charters on the spot market obtained considerably lower rates.

FREIGHT RATES

European short-sea

FREIGHT RATES

European short-sea

On the European routes rates were far more resistant than on the long hauls. Generally speaking, spot freight rates came down significantly up until the 3rd quarter but then picked up strongly in the 4th quarter to finish the year at levels where they had begun twelve months earlier.

The inter-Mediterranean markets, as well as the movements up to northern Europe, were the most active.

In the Mediterranean, owners had a surfeit of cargoes to choose from. Spot demand at certain times was close to the contractual quantities being covered, and freight rates were often at significantly higher levels than those of term contracts.

Modern ships, as well as older ones less easily accepted by charterers, found ready employment. The renewing of the fleet of regional owners, which might have taken place with the disappearance of the oldest ships, was very limited. This was compensated by the arrival of modern ships from North European owners, who in addition to standard round-trip movements between North Europe and the Med, also stayed for longer periods in West Med.

In the East Med this same phenomenon should re-occur in several years time for stainless steel carriers, if freight rates continue to progress in this zone.

The inter-European market was a little less active on spot voyages and, as usual, was mainly concentrated on contractual nominations which was relatively intense. Charter contracts that finished at the end of the year were renewed with a 4 to 6% increase for 2006. These figures are to be taken circumspectly, as they can vary considerably according to the age of the contract and destination. Some contracts only have limited interest to owners and it has been frequent to see only one offer being proposed during negotiations.

Long haul movements

In 2004, having attained peak freight levels which had not been reached for nearly 10 years between the US and Europe, the trend began to inverse itself as from the first quarter 2005. Despite a good volume of contractual cargoes, the very scarce spot demand forced owners to revise their rates downward in order to fill up the space on their ships. Rates for lots of 2,000 to 3,000 tons slipped from $ 60 to $ 50 and $ 40 per ton respectively during this period. At the same time lots of 5,000 tons went from $ 45 down to $ 35 per ton.

Traditional volumes of cumene and styrene were down, but products such as benzene and paraxylene saw their exports increase, thus assuring a certain base load of business.

In the other direction, from Europe to the US, there was a similar declining trend, but the revival in oil products' movements compensated and stabilised the market in the second half of the year.

The two hurricanes that ravaged the Gulf of Mexico provoked an increase in demand for goods leaving Europe. American companies massively imported basic chemical products, including caustic soda, MEG, and benzene.

Consequently, ships were ballasting to Europe to compensate for the lack of cargoes leaving the Gulf of Mexico. Within 6 months, the rates for lots of 5,000 to 10,000 tons towards the US shot up, going from $ 35/38 to nearly $ 60 per ton.

In the space of several months, the lack of available tonnage together with the hike in the bunker prices, contributed to a sharp rise in the spot market.

All production sources helped to fill the gap, be it Europe, Asia, or the Middle East, and they all gained from this revival in activity. Owners were trying to position their ships to be in the loading zones. Movements from Europe to Asia were also affected by the same lower tendencies in the first half of the year. At the start of the year, rates were nearly at $ 115 per ton for lots of 1,000 tons, when a drop of nearly 30 % took levels to their lows in the summer. Size lots of over 5,000 tons were not so badlyaffected.

From the end of the first quarter, demand recovery for chemical products in Asia helped the market improve, and for freights to rapidly take off, to reach levels similar to those at the beginning of 2004.

This improved freight market allowed owners to fix cargoes above $ 100 per ton, in particular for small lots of 1,000 tons and to approach this symbolic figure for the bigger sizes.

Ta'wan and Korea have become more important importers than China for supplies of styrene, BTX, and paraxylene.

Asian demand has allowed a good utilisation of carriers, notably thanks to speciality chemicals such as MEG, phenol, 2-eh, glycols, butanols, ACN, MMA, chloroform and CTC.

At the end of the third quarter, Chinese buyers reduced their imports due to the European product price levels. This resulted in a temporary drop in rates, but the market has been on the rise again since October.

From a general point of view for long hauls, 2005 was rather disappointing concerning voyage charters.

Owners have suffered from the sud-den changes in the market and have had to adapt quickly to reposition their ships between the different geographical zones.

THE FLEET

THE FLEET

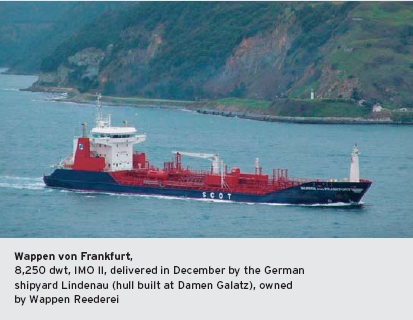

After the record year of 2004, with over 50 new stainless steel chemical carriers being delivered, the delivery rhythm was considerably reduced in 2005 with 39 ships delivered for 754,000 dwt, which brings the average age of the fleet to 11.4 years. The delivery of another twenty ships had been foreseen, but in addition to some orders being cancelled, a number of shipyards have put back their deliveries into 2006.

Ten new ships were delivered in the 6,000 to 10,000 dwt sector, and 29 ships of over 10,000 dwt. With some 50 carriers scheduled for 2006, of which a majority in the 10 to 20,000 dwt category, the orderbook remains well stocked. The number of chemical carriers due to be delivered in 2007 is practically the same as the 2006 forecast, but their tonnage size is bigger on average, with the major part also being in the 10 to 20,000 dwt capacity. With the number of orders being lower in 2005, a large number of these ships were ordered in 2004.

At the same time, the relatively healthy state of the market has limited the number of stainless steel carriers being scrapped.

On the whole, 2005 was a good year for owners as the majority of movements were based on contracts negotiated during the rise in 2004. However, the record prices of bunkers largely contributed to the increase in running costs and, consequently, lower profits.

* * *

2006 SHOULD BE A TRANSITIONAL YEAR: the long term trend downwards could carry on for a while, to the extent that the market will take some time to absorb the delivery of new vessels, although a return to some sort of equilibrium should still be possible for certain periods of the year. In practice, international trade is growing at a rate of 6 % per year, and a reduced number of chemical carriers to be built was signed up this year, due to a rise in building costs and a lack of available slots in the shipyards.

Beginning in 2007, the introduction of the new legislation for transporting vegetable oils will have an impact on the market and will cause some older tankers to disappear, which up till now have been carrying a substantial share of cargoes.

Last but not least will be the level of freight rates on the oil products tanker market. Over the last two years, product tankers, whose market has become very profitable, have encroached very little into easy chemical trades, and this year some chemical carriers have even made inroads into the oil product market, which has been firmer. However, should this market show signs of weakening, product tankers could again start to show interest in the bigger lots of easy chemical products and start competing with the traditional owners in this sector.

Shipping and Shipbuilding Markets in 2005

I N D E X