The ro-ro market in 2005

A year of consolidation against the flow

2005 WAS CHARACTERIZED BY RECORD RATE LEVELS THROUGHOUT THE MAJORITY OF THE SHIPPING MARKETS, in great part as a result of the latter's close connection with the booming Chinese economy. The ro-ro market stood out as an exception to this trend, to a certain extent due to the fact that the bulk of its activity is centered on the European continent.

As we have pointed out in the past, ro-ro trades have increasingly re-aligned to 'short sea' routes whose geography often offers a viable land-based alternative. This ultimately has limited any potential freight hikes and consequently operators' ability to operate chartered tonnage at high rates. The resulting climate has proved extremely challenging when attracting investors whose attention was obviously drawn towards other markets, perhaps more volatile and speculative, but substantially more rewarding. In addition, any appetite to invest in newbuilding tonnage to play on the tramp market was further dampened by the yards' soaring newbuilding prices.

The most straightforward conclusion arising from such a backdrop is that the smaller operators were increasingly at pains to maintain their position as outsiders. In fact, despite its relatively small size, the ro-ro market is increasingly concentrated within the hands of a few large-scale operators, endowed with solid financial foundations. This in turn is due to a number of factors. First and foremost is the difficulty for operators to locate suitable tonnage on the charter market to meet the increasing demand of shippers. Amongst the 58 ro-ro vessels presently on order, none is exclusively destined for the tramp market, which implies that this trend will not be reversed anytime soon. For most operators, then, the only real alternative for survival is to either purchase quality second-hand tonnage or to order new vessels.

It should then come as no surprise that throughout the course of the year, both the second-hand market and the newbuilding markets were characterized by price increases of around 15 %. Small operators, constantly striving to improve the quality of the services they offer, face a road that is ever more uphill and are increasingly becoming acquisition targets for their larger competitors. These 'Goliaths', in turn, have acted preemptively and have proceeded to scoop up the best vessels available for purchase, whilst the most courageous have added more units to their orderbooks. Last but not least, is the tendency of the fittest operators to display themselves as logistics companies, investing in dedicated port terminals, in the same manner as the major containership operators or deep-sea car carriers, further raising the stakes against their smaller peers.

To illustrate the above points, we wish to point out the following representative acquisitions and developments:

»

The acquisition of Norse Merchant Ferries (NMF) by the A.P. Moller subsidiary Norfolkline. Finalised during the third quarter of the year, this takeover propelled Norfolkline amongst the industry's forerunners, with a portfolio of no less than 16 ro-ro and 3 ro-pax newbuildings from Samsung (the first, 'Maersk Dunkerque', is already delivered). During the course of the year, Norfolkline took delivery of the two former UN vessels, 'UN Akdeniz' and 'UN Karadeniz' renamed 'Maersk Vlaardingen' and 'Maersk Voyager' respectively, which appear to be earmarked in the long term for deployment in a new route between north Spain and north France, which could qualify for Marco Polo funding.

»

The purchase by Grimaldi Naples of the 'Dart 2' (1,225 lm ' 15 knots ' built in 1984) at a reported price of 4.7 million ', as well as the 'Norse Mersey' and her sistership 'Massilia' ex 'Linda' (1,950 lm ' 18.5 knots ' built in 1995) for a price of around 20 million ' each. In addition, we should not overlook the increasing stake that Grimaldi has in Finnlines, which bodes well both for the creation of further synergies between the two groups and for further expansion of North / South trades in connection with EU subsidies. Grimaldi's 'Eurostar Network' in the Mediterranean was recognized as the most successful in the Marco Polo program.

»

Cobelfret's order of 4 ro-ro from Flensburger (2,600 lm ' 19 knots), with deliveries scheduled between end 2008 and 2009.

»

CMA CGM's takeover of Delmas, which gives the former a de facto presence on the West Africa trade lane. Its presence is also ensured on the short sea in the Mediterranean through the former Delmas subsidiary Sudcargos, which came under CMA's complete control after the latter bought out SNCM's stake. It will be interesting to follow the evolution of this player in the ro-ro market in light of its impressive success in the container market.

»

Transfennica's complete takeover by the Dutch group Spliethoff, following the latter's purchase of a majority stake in 2002.

»

The appetite of DFDS, which ordered a sixth unit of 3,800 lanemeters from Flensburger and chartered two newbuilding units (3,400 lm) for 10 years, ordered at the Chinese yard of Jinling by Nordic Holdings. DFDS's rapid growth on the Baltic trade will no doubt be bolstered by such a preemptive strategy. Additionally, DFDS purchased the Goteborg / Killingholme route launched by Cobelfret only 18 months earlier with the less sophisticated 'Britta Oden', 'Anna Oden', and 'Eva Oden' (1,600 lm ' 15 knots) against DFDS.

»

The likely purchase of P&O by the DP World group of Dubai, marking the departure of one of the Goliaths of the sector.

»

Nordana's purchase of the 'Roxane Delmas' and 'Romain Delmas' (28,000 dwt ' 3,500 lm ' built in 1979 and 1981, respectively) and their deployment on the transatlantic route, which makes Nordana (together with Grimaldi's ACL) one of the few players operating with large ro-ro vessels alongside the many PCTC units on this trade lane.

»

Seatruck's order for 4 newbuildings (1,800 lm ' 22 knots) from Spain's Astilleros de Huelva, two of which are destined to replace its older tonnage on the Irish Sea. The further development of this shipowner will be interesting to follow given the fact that the Clipper group, of which Seatruck is part of, has a true tramp owner spirit.

»

K-Line intense chartering activity via its European short sea subsidiary (KESS ' the result of the buyout of its original partner Harms). K-Line is amongst the few long-term shipowners attempting to strengthen their synergies by developing a feedering network in the Mediterranean as well as in the Caribbean and in the Far East.

»

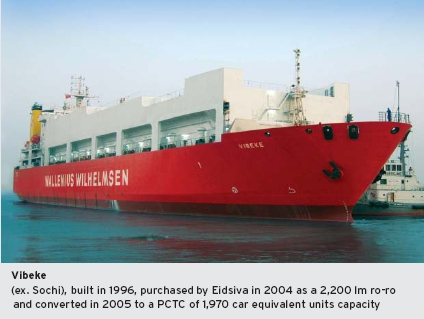

UECC's interesting decision to charter the 'Transgard' (1,500 lm) for a period of 10 years on the basis of a conversion of the unit into a speedy PCTC of 1,200 car equivalent units (ceu) capable of doing 20 knots. It can be compared to the earlier conversion of the 'Sochi' and 'Novorossiysk' sisterships (2,200 lm), bought in 2004 by Eidsiva and converted into 1,970 ceu PCTCs and operated by WWL. These actions are symptomatic of the market's virtually chronic lack of supply of vessels in this segment.

»

Spain's Acciona Trasmediterranea turned out to be equally active on the chartering side after having captured a substantial slice of the tenders of CAT and GEFCO.

»

The Louis Dreyfus group, a newcomer in this market but with a presence spanning different fronts (as tonnage provider for Airbus through its joint venture with Hoegh), has been very dynamic through its subsidiary LD Lines both on the sale and purchase side as well as in chartering. Also of significance is its association with Grimaldi Naples on the 'Motorways of the Seas' in the Mediterranean, which gives both groups the role of innovators.

Amongst the year's disappointments or unfortunate developments, we point out the following:

»

The closing down of Scandline's Rostock / Helsinki route, partly due to the ferocious competition of the land-based alternative.

»

The cessation of operations at Channel Freight Ferries, whose courage to set up a trade in such a competitive sector must be admired nonetheless.

»

Dartline's decision to abandon its service departing from Dunkirk because it was unable to find a suitable vessel in the market and to reposition itself on the Zeebrugge / Immingham axis in partnership with DFDS. This situation will not be risk free for the future'

»

Suardiaz, very dynamic in the past, whose present actions remain secret. We would not be surprised if in the near future it became a target for 'external growth specialists' given the potential interest that the more modern and sophisticated units of its fleet could spark.

»

The gradual retrenchment of SOL from the North Europe / Mediterranean lane, with two of its units going to Stora Enso. The line's operation will be continued with conventional tonnage at the expense of ro-ro, further limiting the range of action of the ro-ro concept.

»

Seawheel abandoning the ro-ro concept and switching to mixed operations based on container and conventional shipping.

On the shipowning side, we point out the following:

»

The in-house divorce of the Visentini group, with the shipbuilding and tramp shipowning sides each going their own separate ways.

»

Stena RoRo's decision to break with the past and directly operate one of its vessels on behalf of Stora Enso. This shipowner, who this year ordered two ro-pax vessels (3,000 lm ' ice class 1A), historically chartered out tonnage on the tramp market and to its sister company Stena Line.

The landscape is no doubt changing, but the price being paid is the volume of chartering activity. The ro-ro market remains characterized by its narrow geographic penetration, a weak fleet renewal rate, and numerous land-based alternatives to the maritime solution ' all factors that can only lead to a lackluster rate environment. Increases in trade volumes are rarely generated by new routes, rather they are linked to incremental increases of volumes on already existing routes, which goes hand-in-hand with a boost in the capacity and the speed of the vessels deployed. The historic peaks in the charter rates remain the product of extra-economic phenomena, such as military interventions in global hot-spots. The ro-ro concept endures in these niches, but the latter's number is consistently shrinking.

We believe that the rise in the second-hand sale prices of vessels, which was stronger throughout the course of the year when compared to charter rates, heralds a potential structural comeback of charter rates during the year 2006. The risk, however, is that the gap will widen even further between those vessels capable of complying to the often rigid requirements of specific trades, and those that will become obsolete and whose age will inevitably lead them to be scrapped in the very near future. In a global context of enduringly high oil prices, the interest will naturally shift to highperformance vessels sophisticated but at the same time endowed with state-of-the-art fuel-efficiency systems that will allow the ro-ro concept to endure.

Shipping and Shipbuilding Markets in 2005

I N D E X