The tanker market in 2005

Crude oil transport

Refined oil products transport

Crude oil transport: the year of consolidation?

The rates and average returns obtained over the past twelve months allowed owners to continue benefiting from especially favourable conditions, as we shall see later in this study. This is even more remarkable in that the world fleet is in continuous expansion and because the rhythm of orders, although slightly tempered, is still far superior to what we saw prior to 2003. Thus the world demand for energy does not abate, helped in this respect by the remarkable economical development of some countries relatively absent from this scene only a few years ago.

If 2004 was the year of all records, 2005 was one that was far more 'reasonable'. We concluded our previous report with the prediction that rates could come back to the already heady averages seen in 2003. Perhaps it is by coincidence, but events have proved to follow our thinking and that various elements, which we shall examine later, show that the markets have consolidated. They also demonstrate that the signs of a brutal collapse in the short term, which some predicted, are not in fact in evidence.

A first observation: a sort of seasonality seems to be characterising the freight market more and more, with a first and last quarter undergoing extreme pressures in contrast to the middle period, which is often fairly flat. Even though weather conditions naturally continue to have a significant impact, with the stock build at the approach and during the winter, the year 2005 will be historic in this respect. The record number of hurricanes affecting the Caribbean zone (in particular New Orleans and American oil production facilities) had inevitable repercussions on oil prices, briefly breaking the $ 65 a barrel level before settling out around $ 55 at the end of the year. These climatic upheavals obviously had an influence on freight rates. However, the hurricanes are certainly not the only cause of the rise in rates. As we shall see further on, the transit of the Turkish straits, which is seeing a continuous rise in the volume of traffic coming from the Black Sea, experienced the traditional winter delays, which has also affected rates.

With regards to world energy statistics, the following table shows an increase in world oil demand of about 1.2 million barrels/day between 2004 and 2005, with prospects of a similar rise for 2006.

At the same time, supply sources are changing and one can see a growing share in the part of non-OPEC producers as well as countries from the former Soviet Union.

Before making a more detailed analysis on the evolution of freight rates within the main tanker sizes, it seems essential to take a brief look at changes that are happening within the main consuming countries and the effects these are having on shipping patterns.

We can thus see, even if it has somewhat slowed down, that the rate of growth of the Chinese economy remains particularly impressive and that the impact is in proportion to the scale of the country. Forecasts for 2006 show a demand for 7 million barrels per day and a GDP growth rate of 9 %.

Faced with the growth of the world fleet, which many consider to be a factor in the inevitable drop in freight rates, there is the compensating tendency to see an increase in transport needs in terms of ton-miles. To illustrate this, China and India, whose demands are continuously rising, are buying more and more light crudes from West Africa and even Algeria. It should be recalled that the trip West Africa / China is 70 % longer than a voyage from the Middle East Gulf to the same destination. For the same amount transported, this translates to a need of 28 VLCCs from West Africa compared to 17 from the Gulf. In the same manner, the drop in oil production from certain European fields is causing a lengthening in supply routes, and therefore an increase in voyage times for tankers.

VLCC

Two main observations can be made when looking at the freight graphs over the last three years. As we have already mentioned, the scenario of 'strong' first and last quarters with the middle of the year being calmer seems to be repeating itself. In addition, if we compare the average returns on the main routes, we see that the bottom prices reached in 2003 are always inferior to those of 2005, and that the peaks of 2005 were above those of 2003.

Therefore, apart from the year 2004 and, above all, its last quarter which was completely out of proportion, we can see on all benchmark routes that the average returns progressed from around $ 52,500 per day in 2003 to nearly $ 59,000 per day last year. This is even more significant if we take into account the strong upward pressure which prevailed last year on bunker prices. For example, the average price for fuel oil 380 cst was slightly below $170 per ton in Singapore in 2003 and above $ 270 last year'

However, it is worth noting that just on the Middle East Gulf ' East trade route, the rates and average returns rarely changed. This is largely due to the persistent influence of single-hulled tankers, which are largely paid off and are preponderant on this traffic. In practice, the safety standards imposed in Europe and the US are far from being systematically applied in the majority of importing countries, be it India, China, or even Japan.

It is important to remember that 15.6 % of the VLCC/ULCCs currently in service are over 15 years old and that 103 tankers (21.7 % of the fleet) are on order which will progressively come onto the market from now until 2010. One of the main question marks concerning the future of this sector relates to not only the evolution of the chartering policies in the countries we have mentioned, but also the attitude of the Middle East countries concerning the safety of their exports.

With OPEC members not having significantly changed their production quotas this year and Iraq not having yet recovered its pre-war production levels (despite huge efforts), one was also able to see a slight increase in the number of cargoes contracted on the spot market. On a monthly average basis their number fluctuated between 102 and 121 (an average of 112) over the last 12 months (compared to 108 in 2004).

As for the two principal consuming countries of single-hulled VLCCs (China and India) we can expect them to maintain their flow of imports with forecasted economic growth always near 9 % and 6.5 % respectively.

However, as was often the case this year, as soon as the rhythm of demand weakens, it is the owners of single-hulls who push rates down, always on Middle East to Far East movements.

Consequently, even taking into account the continuous rise in world demand for transport, the constant arrival of newbuildings on the market and the very few candidates for scrapping could give rise to the creation of a two-tiered market in 2006. Single-hulled tankers that are less than 20 years old (very largely a majority in this sector) are still far from being affected by the measures of their elimination taken by the IMO in the context of the Marpol Convention, and will continue to dominate the market East of Suez, with returns most likely to be inferior to those of 2005.

In contrast, modern double-hulled tankers should be able to resist this trend better as long as on one hand, charterers keep reinforcing their selection criteria (BP is following Total by imposing double-hulls as from 2006 as a chartering requirement), and on the other hand, the utilisation rate of these VLCCs loading out of West Africa for long voyages continues to rise. Evidence of this situation was given at the end of the year when rates out of the Gulf were dropping, whilst they remained firm and steady in the Western zone with returns of over $100,000 per day.

Additional proof of this tendency towards a two-tier market is the analysis of the 'eligible' fleet (taking into account the criteria of choice being imposed by the main charterers), showing that despite the sustained arrival of new units (some twenty in 2006), there are still no signs of tonnage surplus.

Suezmax

As with the VLCCs, freight rates have been fluctuating along the same lines over these past twelve months, with the start and end of the year seeing strong upward pressure and high returns, even better than what was envisaged by owners at the beginning of 2005.

Taking all routes into account and despite the strong hike in bunker prices, average returns, though below those of the preceding year, were above those of 2003, giving further sign of the consolidation of the market.

On two routes which are characteristic of this segment of the fleet, the weighted average for the year came out to around $ 43,000 per day for West Africa ' Gulf of Mexico voyages (compared to $ 35,000 per day in 2003), and slightly over $65,000 per day for cross-Mediterranean voyages (compared to $50,000 in 2003). For these same movements, the peaks achieved were slightly over $80,000 and $120,000 per day respectively, at the end of the year.

The age structure of this segment of the tanker fleet is being continuously rejuvenated, since as of today, nearly 83 % out of some 335 tankers in service are less than 15 years old and nearly 37 % are less than 5 years old. The average age of the world fleet is less than 9 years today.

However, the volume of tonnage on order (65 units of which 50 are to be delivered between 2006 and 2007), the strength of world demand, but above all, the geographical spread of traffic between the different zones, will play a vital role in determining whether rates can continue to hold up throughout 2006.

Compared to the VLCC category, an analysis of the eligible Suezmax fleet shows a real risk of overcapacity in tonnage as from the end of 2006'

Demand is becoming increasingly volatile out of West Africa as VLCCs are taking on a preponderant role and the Suezmax rates are often comparable to those being achieved by the bigger units. On the brighter side, the exploration and production, particularly in the deepwater offshore -notably in Angola- is continuously being developed with good prospects regarding future exports from this zone.

Whilst loadings from the North Sea and the Caribbean tend to be stable, we have been able to see a significant rise in loadings out of the Middle East Gulf, allowing a number of single-hulls, which have been relegated to this region to pocket some handsome profits with peak rates never seen before (WS 285 for voyages to China).

As was the case in 2003, and not far from those obtained in 2004, the average returns encountered in the Mediterranean were particularly beneficial to owners. Here, more than elsewhere, seasonal effects were emphasised with a winter period that was particularly sensitive to weather conditions. Bad weather combined with a growing traffic out of the Black Sea produced some extremely heavy and long bottlenecks for the transit of the Turkish straits, even more than in 2004. Thus at the end of the year, accumulated waiting times to transit the Dardanelles and the Bosphorus on a round trip basis was more than 20 days, affecting available tonnage as well as freight rates.

Two main uncertainties exist concerning the future of the Mediterranean market in 2006. Firstly, will Iraqi exports loading out of the Ceyhan terminal pick up after the numerous sabotage attempts this year against this pipeline? And secondly, will the coming into service of the C.P.C. pipeline (Caspian Pipeline Consortium), which should link the Caspian to the Ceyhan terminal from March, compete with the volume of Black Sea exports, or will it simply serve as an alternative exit in the event of bottlenecks through the Turkish straits?

Aframax

Aframax

This category of tankers is undeniably where one finds the highest proportion of old units, since nearly 25 % of the 665 tankers currently in service are over 15 years old. With some rare exceptions, the old tankers continue to work East of Suez, with the majority being modern units in the West. Combined with this, the bunching in this size of ships is particularly bad. In fact, the orderbooks are still extremely full, with more than 100 ships due to come onto the market between 2006 and 2007!

Consequently, and more so than for the VLCC and Suezmax categories, an analysis of the eligible fleet clearly shows that we have already attained the same level of 'eligible' tonnage at the beginning of 2006 as the one that was reached at the end of 1999. This trend will continue for the next three years and at the end of 2008, the total fleet will reach over 65 million deadweight tons (only comprising double-hulls), compared to around 50 million dwt end 1999 (for tankers under 25 years ' single and double hulls). It goes without saying that, on one hand, world demand will not decrease and that, on the other hand, the configuration of the East of Suez market has to change quickly if owners want to avoid the start of a crisis'

Looking at the freight rates and returns achieved this year for the new double-hulled units, a very strong resemblance to the previous two years can be seen, the main significance being high levels at the beginning and end of the year and a much calmer middle period. Despite the very high bunker prices, returns on the main routes West of Suez are slightly below those of 2004, but remain considerably higher than those of 2003.

Similarly, for cross-Mediterranean voyages the time-charter equivalents for 2005 were close to an average of $45,000 per day, compared to $38,000 per day in 2003 and $54,000 per day in 2004. On short cross-North Sea movements the same average returns were $57,000, $46,000, and $64,000 per day respectively.

Whilst these averages remain very favourable to owners, one should remember the intrinsic volatility of the market. For instance, the extreme values registered on cross-Med voyages like Banias/Fos dropped to a low of WS 105 ($ 17,000 per day) in mid July, and then touched a high of WS320 ($ 81,500 per day) at the end of October. These erratic movements are often very difficult to predict, but it is nonetheless the case that the market reacts strongly on the upside. As for the Mediterranean market, the other essential element is the volume loading out of the Black Sea with the delays through the straits (already evoked earlier) having a big influence on available tonnage and thus the rates.

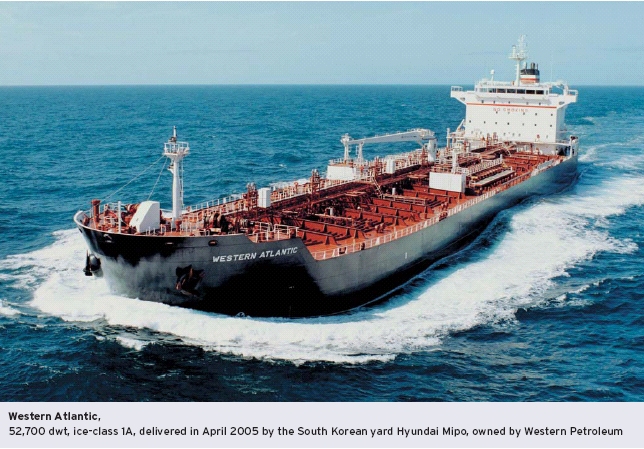

As for the traditional cross-North Sea movements, although there has been a slight decline in loadings out of the old terminals, traffic leaving the Baltic (particularly out of Primorsk) is continuously rising. However, contrary to past years, rates for ice-classed ships did not record any premiums during the winter period. This is largely due to the fact that this category today includes more and more new ships (18 units were delivered in 2005 and 44 are in the orderbooks).

In the Caribbean market, rates also fluctuated wildly over the last 12 months, with the levels going from WS 125 ($ 15,000 per day) at the end of July up to WS 360 ($ 70,000 per day) mid November. The weighted average for 2005 on trips to the US was WS 217.5, compared to WS 255 in 2004 and WS 207 in 2003.

Conclusions and prospects

As we have seen from this study, 2005, despite differing considerably from 2004, has been the second most profitable year for oil tanker owners since 1973. In addition, forecasts of energy consumption in general, and oil in particular, continue to increase steadily, with certain countries, which previously were discreet players, now progressively becoming predominant.

These results are all the more remarkable (compared to the already promising ones of 2003) in that the world tanker fleet recorded one of its highest growth in 2005 (more than 7 % increase over 2004).

The coming two years will again register a significant rejuvenation of the fleet with numerous new units coming into service.

Despite the price of steel tending to be lower, the cost of these new tankers is not dropping significantly (just marginally for Aframaxes).

At the same time, rates achieved during the last few months for long term charters are symbolic of the optimism which still prevails amongst owners. Thus on the basis of a one-year time charter for a modern unit, costs are around $55,000 per day for a VLCC, a little less than $40,000 per day for a Suezmax, and $35,000 per day for an Aframax.

However, based on a 5 year con-tract, rates work out to around $ 42,000, $ 35,000, and $ 25,000 per day respectively, proving that the strong growth in tonnage from now until 2008/2010 will, in the end, have some negative affect on freight levels.

Consequently, overall in 2006 one can expect that the average spot market rates to be at levels somewhat lower to those of 2005, but far from suggesting any 'crisis' which would be along the lines of what we witnessed some years ago.

In practice, on one hand, owners are much better organised today than ever in the past, and on the other, profits which the same owners have enjoyed over the past three years have been such, that they allow them to face temporarily less favourable market conditions in the months and years to come.

One of the unknowns which remains concerning the future of the freight market, includes the real rate of scrapping of the old single-hulls and whether this will take place before effective and mandatory measures are enforced by international organisations.

The crude tanker second-hand market

'Long may it last!'

These were the words used by Laetitia Bonaparte, the emperor's mother, hearing the good news about her son, Napoleon, which came to her 200 years ago in December 1805, after being victorious in the battle of Austerlitz, several weeks after having been defeated at Trafalgar.

Crude tanker owners are currently in a similar state of mind after last year. 2004 had been exceptional and the year 2005, all considered, has been very satisfactory as well. There must be many owners who would be more than happy to maintain current rates of return in the long term as well as the current values of their assets. But this remark implies that owners are aware that on the one hand, nothing is guaranteed and, on the other hand, choosing the moment of a sale or purchase is crucial in order to consolidate or keep their companies in business.

At the end of 2005, the value of ships, old or modern, single or double-hulled, was still very high. But we have seen over the past months, that the market has been divided into segments, and that several very characteristic and visible divergent trends appeared, in contrast to the end of the previous year, when prices of all ships were shooting up. In 2005, logic prevailed and, at last, only the values of double-hulled ships firmed up, while those of single-hulls weakened. This drop is partly linked to the lower rates that they obtain, but also to the investors' fears of seeing the commercial life of these tankers coming to an end in 2015, in the best case, and 2010 in the worst. As a result, single-hull values lost between 5 % and 15 % in a year. In comparison, the value of double-hull tankers was able to maintain the peak prices obtained in 2004, sometimes even exceeding them by a small percentage.

In April 2005, the guillotine came down on the IMO Category 1 tankers (pre-Marpol, non SBT), as well as those of Category 2 (post-Marpol SBT), built before 1978. The enforcement of this legislation had little effect on the market, as owners had anticipated these measures over the course of the past few years. The virtual absence of scrapping of this type of ship demonstrates this perfectly. Whilst there is no doubt that hurricanes Katrina and Rita wreaked havoc within the product tanker market, it is true that they also affected the crude tanker market. The increased activity, which these climatic catastrophes brought about, have allowed values of double-hulls to rise and prevented single-hulls from declining further after September.

As was the case last year, there were very few modern tankers candidates for sale. This obviously contributed to the increase in value of second-hand ships, as did the sustained high price level of newbuildings, for which shipyards are proposing later and later delivery dates. Another similarity has been the high number of ships sold en-bloc, most of the time to companies quoted on the stock exchange.

The second-hand market for VLCCs

Contrary to 2004, in which the sector saw a very sustained level of activity in terms of done deals (82 sales), 2005 was quite calm since there were only 34 units that changed hands. Throughout the year, owners remained very confident in the capacity and returns of their tankers and had no desire to dispose of them. The volume of transactions therefore returned to its usual pace, since if we look back at the previous years, 44 units were sold in 2003, 24 in 2002, and 37 in 2001.

As was the case during the previous year, only four VLCCs from the 1970s were sold for further trading or for conversion, such as the t/t 'Tai San', 310,990 dwt, built in 1977, for a price around $ 30 million. This vessel had been acquired by the seller in 2003 for $ 10.2 million.

Nine single-hulls, built between 1980 and 1995, were sold to mainly Asian buyers, and it is worth pointing out, amongst these, the healthy appetite shown by the company Titan Ocean. This owner acquired 6 out of the 9 units sold. It has intelligently been renewing its fleet, since he also appeared amongst the sellers of tankers built in the 1970s that we mentioned in the previous paragraph.

To illustrate this, we can mention the sale of m/t 'World Prelude', 265,243 dwt, built in 1988, to Singapore buyers for a price of $ 55 million in March 2005, and that of 'Vasant J. Sheth', 261,167 dwt, built in 1990, for $ 60 million in April.

The number of double-hull ships built after 1993 and sold this year has, therefore, been the core business, as 21 transactions have been registered. There were 31 deals in 2004, 23 in 2003, 5 in 2002, and 14 in 2001. It is, of course, the intrinsic structure of the VLCC fleet which explains the predominance of double-hulls in the second-hand market, since single-hulls only represent a meagre 27 % of the existing fleet in this category. These 21 transactions largely comprising either declaration of options, en-bloc sales, refinancing or sales to the KGs. Thus at the beginning of the year, we saw a declaration of purchase options being exercised on 'Front Century' and 'Front Champion', 308,000 dwt, built in 1998 and 1999 respectively, for a total of around $ 142 million. The beneficiary of these options was able to realise an immediate profit, as these same ships were subsequently refinanced by another company within the group for nearly $196 million. Amongst the en-bloc sales, we can also mention that of m/t 'Crude Guardian', 290,000 dwt, built in 1993, m/t 'Crude Creation', 300,000 dwt from 1998, m/t 'Crude Topaz', 319,000 dwt, built in 2002 and the hull 'Hyundai Samho 214', 319,000 dwt of 2005, for a total price of $ 477.5 million to European buyers. Individual sales of VLCCs were very scarce as we only recorded 5, including m/t 'Folk Star', 300,000 dwt, built in 1993, for a price of about $ 89.5 million in July.

This year only one VLCC went for scrap, so virtually nil, compared to 5, 27, and 36 respectively in the past 3 years, despite the very attractive prices being proposed by the scrapyards. At the same time, 31 new VLCCs joined the fleet this year and the orderbook stood at 103 vessels at the end of December 2005. This figure is similar to the 105 units recorded in 2004, and reveals that owners were still optimistic but reasonable, refusing to accept the extended delivery dates being proposed by the shipyards.

The Suezmax second-hand market

Ships from 120,000 to 200,000 dwt saw a impressive volume of transactions: 60 changed hands in 2005. We recorded 43 sales in 2004 and 53 the previous year.

Prices of this type of tanker have been relatively stable throughout the year, both for the most recent single-hulls (1990-1993) and for the double-hulls. Two major deals occurred in the year: one was the en-bloc sale of the single-hull Suezmax fleet of Genmar to Tanker Pacific (10 ships) for about $ 295 million, and the other was the en-bloc sale of the double-hull Suezmax fleet of Ceres Hellenic to Euronav (14 Suezmaxes et 2 Aframaxes) for $ 1,070 million. This year, again, en-bloc sales dominated the market, as only 10 ships out of the 60 were sold as individual units.

Two ships, built in the 1970s, changed hands for further trading, but these transactions were somewhat anecdotal, being a deal between North American owners on US flagged ships.

Twenty-two single-hulls, built between 1982 and 1993, were sold this year, of which ten Suezmaxes from the Genmar fleet. As with the VLCC category, we saw the large buying appetite being displayed by Ocean Tankers. This operator purchased 5 ships, including m/t 'Eclipse', 135,134 dwt, built in 1989, for a price of about $ 29.5 million in April. For reference, 15 deals of this type were reported in 2004, as was the case in 2003. The en-bloc acquisition by Tanker Pacific largely explains this increased volume for 2005.

Just like last year, the majority of deals was centred around modern double-hulls, namely 35 of them, compared to 30 in 2004 and 37 in 2003. Values remained very firm throughout the year and official sellers were non-existent. A good illustration was the sale in January of four hulls n' 1562, 1563, 1564, and 1565 of 160,000 dwt, being built by Hyundai Heavy for $ 80.5 million each, on the basis of a prompt delivery in 2005, and the sale in December of the hull 'Samho S271', for delivery early 2007 at a similar price (this last ship having been purchased one year earlier by its current seller for a price of $ 70 million). For ten year-old ships, values also remained firm. The sale of m/t 'Spetses', 148,500 dwt, built in 1996, for around $ 68.5 million, in May, is an example.

Only two Suezmaxes were sold for scrap this year, whereas 27 new ships entered the fleet (in 2004, the ratio was 10 demolitions for 26 deliveries). The shipyards' orderbook for the coming years (up until 2009) included 74 units at the end of December.

The Aframax and Panamax second-hand market

As with the VLCCs, Aframax sale and purchase activity declined, since only 66 tankers changed hands in 2005, compared to 114 the previous year. In addition to traditional Aframaxes, ships in this category also included some vessels of 60,000 to 80,000 dwt with a width exceeding 32.20 metres.

No sales for further trading of Aframax tankers built during the 1970s were reported this year.

Sales of single-hulled Aframaxes built after 1980 represent 40 transactions (there had been 45 the previous year) out of the total of 66. It is consequently the sales of modern double-hulls that have strongly decreased. A situation which already occurred last year has been repeated: buyers of single-hulls were mainly Chinese, Indonesian or international companies, based in the Far East. These owners have the opportunity of using these ships in their respective geographic zones. By and large, prices for these types of ships held up well throughout the year and only the oldest saw a drop in levels at the end of the year. This can be illustrated with the example of the sale of the m/t 'Tamyra', 86,843 dwt, built in 1983, for about $ 10.5 million, and the en-bloc sale of the m/t 'Sabine Spirit', 'Hudson Spirit', 'Columbia Spirit' of 81,300 dwt, built in 1988, for a combined price of $ 66 million. Another significant deal in this category done this year was the sale of 6 single-hull Aframaxes by Genmar to Seatankers, for a total price of $ 127.5 million.

Demand for modern double-hulled Aframaxes was, again, very strong, but deals remained scarce; only 26 sales in 2005, against 39 in 2004. Despite the volatility of the market, owners of this type of ship quite simply preferred to continue operating them rather than to selling them. The few sales reported showed strong values, higher than last year. For instance, the sale of the m/t 'Bravery' of 110,461 dwt, built in Croatia in 1994, which went for $ 42.5 million, and the sale of the m/t 'Queen River', 107,081 dwt built in 2003, for $62 million to Indian buyers. Few en-bloc sales were reported in this age category, which shows a lack in the number of quality candidates.

As with the largest size of tankers, very few Aframaxes were taken off for scrap this year; only 16 ships were demolished compared with 30, 35, and 20 respectively for the past three years. At the same time as the withdrawal of 16 from the fleet, 60 ships were delivered in 2005 and the orderbook has diminished, going from 182 to 162 ships in between the end of 2004 and the end of 2005.

The years follow one another, but are different for the Panamaxes since, in contrast to the previous year when the volume of transactions was low (29 sales in 2004), this year we have witnessed a pronounced enthusiasm on the part of buyers for this segment, with no less than 57 deals. The breakdown by age group shows roughly a quarter for the single-hulls, built between 1980 and 1991 (16 sales), with the remainder being double-hulls. The German KGs were particularly active and did not hesitate at the beginning of the year to acquire double-hulled Panamaxes for the purpose of placing them in pools.

For single-hulls, we can quote the following representative sales: the m/t 'Seaway L', 60,000 dwt, built in 1981, for $ 7.25 million and the m/t 'Mary Ann', 64,239 dwt, built in 1986, for $ 15.5 million. A handful of transactions of modern ships were realised en-bloc. For example, we had the en-bloc sale of the m/t 'Penyu Agar', 'Penyu Daun', 'Penyu Pipih', 'Penyu Sisik', 75,000 dwt, built between 2004 and 2006, for $ 200 million.

Fifteen Panamaxes were sold for scrap this year, compared to 13 and 15 respectively for the two preceding years. The fleet has therefore substantially increased in 2005, since 45 new units joined the fleet, without ships' values being affected. At the same time, the orderbook was reduced, going from 168 ships in December 2004 to 130 this year.

The second-hand market of OBO ships

This market has continued to progress, following its revival, which began last year, and has experienced considerable activity, with 16 ships having changed hands. We have seen a marked interest from Chinese buyers, who purchased 7 ships built between 1982 and 1985, of which the m/t 'Pasir 1', 75,470 dwt, built in 1982, and the 'Ariela', 75,590 dwt, built in 1983, sold en-bloc for $ 27 million.

Some more modern OBO ships found takers, notably with B+H, who managed to acquire and charter out no less than four units this year, including the 'Siboeva', 'Sibonancy', and 'Sibonata', 81,750 dwt, built between 1993 and 1994, which were all sold en-bloc for $ 112 million.

This year, we saw just one vessel sold for scrap, compared to four in 2004 and five in 2003.

* * *

Tomorrow's market

The shipyards' orderbook is adequately full to put the fear of any sudden and sustained drop of newbuilding prices aside. The value of the most modern ships in service should therefore remain firm, even if the large growth in new construction capacities could, in the long term, create a surplus of available tonnage. It is probable that the hurricanes of 2005 prevented the oldest ships from seeing their values decline more steeply at the end of the year, but 2006 could in this respect be less favourable.

We should remember that ships in the IMO Category 2 (post-Marpol, SBT) will progressively leave the fleet between now and 2010 and/or 2015, based on decisions which will be taken by certain countries and flags. In 2006, ships built between 1978 and 1979 are concerned. Many are questioning as to whether ships in the IMO Category 2 will begin to disappear between 2010 and 2015. Of course, we ask ourselves this question, but it seems somewhat premature to respond to this today.

Above all, we should keep in mind the effects that recent accidents have had on the structure of the fleet, but also the immediate repercussions on a given market of climatic changes and catastrophes, and, finally, the implications of some political or military decisions in the long term in certain geographical areas. We can only simply say that it is highly probable that we will see other similar crises between now and 2010.

On the other hand, ships are there, still active, often in very good shape and well maintained. If their owners are slowly shifting eastwards, and that certain countries, amongst them Japan, Singapore, and the Marshall Islands, have already confirmed that non-double hull tankers can continue to operate up until 2015, either under their domestic flag or within their territorial waters, it will then be up to the market to decide on their fate. Other countries will apply 'adapted' rules according to their own situation; for instance, the US will allow single-hull ships to use the Loop terminal up until 2015 and will apply the OPA in the meantime, whilst China, for its part, will accept single-hulls flying its own flag, etc.

Consequently, if the main importing countries consider the freight market to be too expensive, and that this situation might continue until 2010, why should they penalise themselves further by refusing to accept quality single-hull tankers within their waters?

As to whether the market will be 'too' expensive in 2010, that is another story'

The transport of refined oil products in 2005

'Nonetheless, except a major event, the year 2005 shows every sign of being propitious to product tanker owners.' was the conclusion to our article in last year's review. Twelve months later, we are pleased to report that our optimism was justified. The 2005 accounts have seen the consolidation of the excellent results registered in 2004 for owners of Handysize and MR vessels, and an improvement of 8 to 10 % for LR tankers owners. The time-charter market has also been active, recording 27 to 30 % higher rate levels for a one-year period.

As in 2003 and 2004, strong growth and development in Asia, particularly China, explains the good results of product tankers in this zone. The performance of ships working in the Atlantic zone was slightly below that seen in 2004, despite the sudden and unexpected hikes linked to the disasters caused by the hurricanes Katrina and Rita.

Rates slipped gradually from December 2004 until May 2005, but continued to be above $ 20,000/day. The lowest levels recorded in the year occurred during the summer, with the market dropping to $ 12,000/day in August in the Atlantic zone, whilst at the same time maintaining a level of around $ 18,000/day East of Suez.

The predicted recovery at the beginning of Winter happened earlier than expected, due to the speculation brought on by the climatic catastrophes, which badly affected American refinery production. At the beginning of September, as in 2004, returns on MRs approached $ 40,000/day, whilst the LRs broke the $ 60,000/day barrier. As from mid-October, MRs saw their daily returns fall back to around $25,000/day, whereas the LRs were able to resist any price erosion until mid-November.

Contrary to the previous year, rates paid for time charters slowly caught up with the spot, making some charterers reluctant to take on long-term commitments at such high levels. However, there were numerous traders and operators who were unable (or did not wish) to postpone their commitments in such a volatile market, resigning themselves to paying record prices for short periods.

Owners rather preferred to settle for fixed prices as opposed to floating rate mechanisms indexed to the spot market or linked to some 'profit sharing' schemes.

This is why, although the market absorbed some 120 MRs and Handysizes delivered in 2005 (totalling 5.2 million dwt) without too much difficulty, it is rather preoccupying to think that in 2006, no less than 140 product tankers, including 81 MRs, will be delivered. In 2007, another 130 units, of which 75 are MRs, will join an already modern fleet.

The evolution of product tanker freight rates in 2005

The Handysize ships from 30,000 to 39,999 dwt

The Handysize ships from 30,000 to 39,999 dwt

The average daily return for ships of 30,000 dwt was around $20,000/day, whereas Handy tankers obtained an average of $25,000/day. These results are identical to those of 2004, even though growth in the Euro zone remained very modest and, as in 2004, there was no ice premium on rates. The market seems to have found a balance at these levels, which explains why the rates for period charters are now very similar to those of the average daily returns. For ships just delivered, charterers are currently paying $20,000/day for periods of 3 years, and from $ 22,000 to $ 23,000/day for 2 years. At the end of the year, the estimate figure for a one-year charter was $ 26,500/day (without any business recorded at this level.)

The Medium Range ships from 40,000 to 49,999 dwt

The average daily return of these vessels was around $ 29,000/day. Ships operating in the Atlantic zone have been favoured less, despite the good standing of dirty products, than those operating East of Suez. The daily returns for cargoes of 37,000 tons ums Continent/Trans-Atlantic have swung between $ 12,500/day, at the bottom of the market in the summer, to $ 41,000/day in September, with the annual average working out at $ 27,000/day. A good part of the fleet was employed for transporting dirty products or crude oil, with the average return surpassing $31,000/day. East of Suez, the market was volatile, but the more numerous opportunities to optimise 'routeing' have allowed owners to obtain the same kind of returns. Trading arbitrages have helped favour the growth of longer voyages East/West (jet and gasoil) and West/East (ums and naphtha).

The strong standing of the market encouraged owners to considerably increase their offers for period business. Some thirty ships were fixed for over 30 months, of which a dozen for 5 years or more. While traders like Vitol, Trafigura or Glencore were again the principal participants in this market, one should also mention the intervention of ship operators such as Norden, Lauritzen or AP Moller, who did not hesitate to take on tonnage for periods of 3 to 5 years.

At the end of the year, one could estimate that a modern MR (less than 5 years) delivered end 2005 / beginning 2006 could obtain $27,500/day for 1 year, $ 24,000 for 2 years, $ 22,000 for 3 years, and near to $ 20,000 for 5 years. The ice premium remained high for long term time charters, since two ice-class 1A ships were chartered out for $ 25,000/day for 5 years and near to $ 30,000/day for 18 months (which includes 2 winters).

The Long Range ships from 50,000 to 90,000 dwt

Helped by naphtha demand coming from China, India, Japan, and Korea, but also by numerous movements of jet and gas oil towards Europe, the LR1s and the LR2s saw their daily returns increase by about 10 % compared to 2004. LR1s achieved an average of $34,000/day, whilst the LR2s were over $ 40,000/day.

The market remained very volatile and saw a strong seasonality, with the bottom being reached in May, when rates fell to around $ 20,000/day. In October however, the LR1s surpassed the $ 60,000/day mark and the LR2s hit their high spot of the year at $76,000/day.

Some twenty charters of at least 24 months were concluded at rates with the highest levels going to ships with the closest delivery dates. Some modern LR1s were chartered for 2 years at rates ranging from $ 29,000 to $ 31,000/day, whilst some LR2s achieved similar levels but for periods between 3 to 5 years.

The number of deliveries of new ships during 2006 puts the average returns for product tankers at risk, with the following being forecasted: 12 ships of 25,000 to 35,000 dwt for a tonnage of 371,000 dwt, 32 ships of 35,000 to 40,000 dwt, totalling 1,180,000 dwt, 91 ships of 40,000 to 55,000 dwt for 4,216,000 dwt, 58 ships of 55,000 to 90,000 dwt adding 500,000 dwt, to which some ten 'coated' Aframaxes will be added, totalling over 1,000,000 dwt.

At the end of 2006, the fleet of product tankers 'eligible' for the oil Majors will represent around 39.5 million dwt (an increase of 16 % over the year). During the course of 2006, it should therefore come back into line with the level that existed 6 years ago. This is not an unreasonable progression, if one takes into account that it corresponds fairly close to the world economic growth in the same period, and that in this interval the need of transport capacity expressed in ton-miles has also grown.

Nonetheless, the situation differs according to the type of ships under consideration. The fleet of 30,000-40,000 dwt (with an average age of 13.6 years at the end of 2005) will only grow by some 60 units in 2006, or some 9 % of the total of existing ships. On the other hand, the fleet of MRs (with an average age of 8.4 years at the end of 2005) will increase by 20 % within 2 years (over 150 units). But the demand for clean and dirty products destined for the American zone and the Far East remains high as well as other factors will help support the demand for modern tonnage.

Growth in the American economy being firm, movements of gasoline towards the US will continue to be the backbone of the MR traffic. The introduction of new standards (Energy Policy Act 2005) should also increase the volatility of an already tight market, and therefore translate into an increase in quantities to be carried.

It should also be noted that in 2005 the fuel oil market in the Atlantic zone was more erratic and on average more remunerative for owners than clean products, and has occupied over half of the available tonnage. The arrival on the market of modern Panamaxes and Aframaxes has not really had too much of an effect on the MRs.

In the Far East, the predominant phenomena continues to be the persistently high level of naphtha imports associated with an increase in regional movements, into and out of China.

Finally, the success of the shipping pools, notably Handymax and Panamax, has inspired MR owners, who now are able to obtain a certain critical mass and increase their presence for long term charters.

In addition, the appearance of new demand will bring with it an increased need for modern ships. Let us not forget that in 2005, about 20 % of tropical vegetable oil was transported to Europe (1.5 million tons) on modern ships built in Asian shipyards (principally South Korean). A third of the Handysizes and MRs delivered last year in Asia began their life with a vegoil voyage heading to the Mediterranean or UK-Continent. About 45 % of the tropical oil carried to Europe was shipped in double-hull vessels.

In contrast, the average age of ships used for carrying soy or sunflower oils out of South America is around 19 years. Less than 20 % of these ships are double-hull, which could have an effect, especially when new regulations for transporting vegetable oils come into effect in 2007. As a whole, the vegetable oil market should give full employment to around fifty Handysize or MR ships.

Conclusion

Conclusion

The product tankers fleet should enter its final phase of renewal during 2006. Even if demand for such ships continues to develop throughout 2006, notably thanks to American and Chinese appetites and despite the endemic weakness of growth in the Euro zone, we have some doubts about the ability of the market to absorb the volume of ships that will be committed over the next two years without any consequences.

The seasonal falls in rates could be deeper and longer in 2006 than in 2005, with the market gradually becoming less volatile, and average returns should consequently be slightly below levels achieved last year. Nonetheless, the persistent regional imbalances will continue to open up hedging possibilities, which will have a positive impact on the demand for product tankers.

Within the context of a more mature market, opportunities will be seized by the most dynamic and best organised players.

The product tankers second-hand market

The market continued its ascension this year, being aided by the quality of the most modern ships, the firmness of newbuilding costs and extensions on delivery dates. This progression, of course was underscored by a firm freight market, which itself was given a boost with the strong demand resulting from the effects of hurricanes Katrina and Rita. The firmness in prices has also been passed on to the older ships.

Apart from the traditional transactions concerning the MRs, which constituted the vast majority of negotiations, there was a marked interest this year for LR1s, a sector in which there were over twenty deals, with Scandinavian, German (KG), Greek and Italian owners being particularly active.

There was a notable transaction in January with the sale of 5 product tankers to Torm for around $250 million. Four of these ships belonged to the Malaysian Bulk Carriers Group (1 ship built in 2003 and 3 built by Samsung for delivery in March, September 2005 and January 2006). At the same time, Torm acquired two LR1s belonging to Wah Kwong (the first shared 50 % with J.B. Ugland Shipping a/s), to be delivered by the New Century shipyard in November 2006 and the other, already chartered out for 7 years, for delivery in January 2007. The value of this type of ship has been continuously increasing since the deal was made 12 months ago.

Elsewhere, a standard double-hull of 45,000 dwt, 5 years old, estimated at around $ 39.25 million in December 2004, appreciated to $43.5 million at the end of June and then $ 45.5 million in December 2005, an increase of nearly 16 % over the year.

The price hikes have also spread to single-hulls of 45,000 dwt and 20 years old, with the value rising from $ 9 to $ 10 million between January and December (+11 %).

On the other hand, there was little movement on single-hulls of 40,000 dwt built at the end of the 1980's, estimated at around $ 16-17 million at the end of 2004 and valued around $17-17.5 million a year later.

Double-hulls of 35,000 dwt built in 1995, with a price tag of around $20 million in January 2005 had a value of some $ 21 million at the end of the year.

In a market which is constantly on the move, one has to keep a close eye on the capacity in service, as well as the orderbooks. Nevertheless, one can be confident with regards to the evolution in the transport demand for refined products, to the extent that the market structure should continue to evolve favourably for owners throughout 2006.

Shipping and Shipbuilding Markets in 2005

I N D E X