FOREWORD BY THE PRESIDENT

- The year 2006 showed again a healthy growth of world trade with,

as a result, an increase of 5.5 % in tonne-miles of maritime

transport - the main carrier of transport international trade.

European shipping maintained its key role in global transport with a

substantial share of 41 % of the global merchant fleet. For

2007/2008 a slightly lower increase in global merchandise trade of 6

% as against 8 % in 2006 is expected. Demand for shipping services

will be positive; however, high fuel costs, imbalances, particularly

in container services and congestion, together with the effects of

tonnage oversupply in some sectors, may have a negative influence.

-

- The key points that are on the agenda of the EU Institutions are

summarised in this annual report covering 2006/2007.

-

- A FUTURE MARITIME POLICY FOR THE UNION

-

- ECSA deeply appreciates the unique consultation process that has

been followed on a future maritime policy and supports a holistic

approach with, as basic points: ensuring the potential for growth in

Europe through adequate transport capacity, ensuring a stable and

competitive environment for EU shipping, keeping regulations global,

supporting a positive development of shipping in the EU, and, last

but not least, taking a proactive environmental approach. These key

points need to be part of the philosophy of the future maritime

policy and we look forward to a continued exchange of views with the

European Institutions and stakeholders in this respect.

-

- It is also essential for ECSA to continue to promote the image

of shipping to convince the public and the political world of what

we, shipowners, all know, i.e shipping is the safest and most

effective, economical, and environment friendly of all modes of

transport.

-

- EUROPEAN TRANSPORT POLICY

-

- A future European Port Policy was also subject to a useful and

constructive consultation process. ECSA and many other stakeholders

stressed the necessity of extension of port capacity and hinterland

connections as a priority item. At the same time we should get the

best from the existing capacity by increasing efficiency.This is of

particular importance for the ongoing promotion of short sea

services and the further development of motorways of the sea.

-

- ENVIRONMENT

-

- Care for the environment has become a key item on everybody’s

agenda. In particular air emissions and climate change are already

today subject to intensive discussions, in the EU as well as

globally. Shipping is by far the most environment friendly transport

mode with a good performance on emissions. However, this is not a

reason for complacency. The industry is and will be increasingly

proactive in looking at different options to further reduce air

emissions on all fronts. It has become clear that a holistic

approach is the only way forward since measures addressing one

emission may have an influence on another.

-

- Shipping being a global industry it goes without saying that a

global solution to air emissions is the sole way forward. The

shipping industry is fully committed to further international

reduction of air emissions in the shortest possible timeframe

through the IMO. It is essential that, following the analysis of all

the various options on the table to reduce air emissions (MARPOL

Annex VI) by the cross government/industry scientific group,

tangible measures are agreed upon by the IMO in 2008.

-

- While shipping only accounts for some 2% of global greenhouse

gas emissions, the industry is currently examining the options in

this regard. By definition, measures to reduce global warming need

to be taken at the global level to be effective.

-

- MARITIME SAFETY

-

- ECSA appreciates that the Council of Transport Ministers has

reached in June a political agreement on three proposals of the

Safety Package III notably dealing with Port State Control, Vessel

Traffic Monitoring including places of refuge and Accident

Investigation. The Council has rightly left the controversial

proposals aside, particularly the proposal on Civil Liability, which

would seriously distort the global maritime liability regime as well

as the insurance and compensation system. ECSA, instead, strongly

advocates the ratification and application of the relevant

international Conventions notably LLMC 1996, the HNS Convention and

Bunker Oil Spills Convention, which will give a proper liability and

compensation system on a global basis.

-

- The European Maritime Safety Agency (EMSA) is increasingly

playing an important role in the areas of safety and environment.The

Board of ECSA had very useful exchange of views with EMSA at its

meeting in Lisbon in June 2007. There is a clear commitment to

working closely with EMSA in the future.

-

- A HECTIC AGENDA AHEAD

-

- Taking over the Presidency of ECSA from Lennart Simonsson, I

would like again to thank and congratulate him for leading ECSA in

such an active and efficient way. The coming period will be hectic

with quite some policy issues on the table. Already in October we

will have Commission papers on a future maritime policy, European

ports policy, logistics, and on motorways of the sea.We will also

have a further consultation process on future guidelines for the

application of EU Competition Rules on maritime transport. The

social partners ECSA/ETF hope to reach an agreement towards the end

of the year on transferring part of the MLC Convention into EU law.

As I mentioned above, the environment and in particular ship

emissions will rightly be a key item on our agenda, in Europe as

well as globally.

-

- I look forward to a continued cooperation with the European

Institutions: the Commission, Member States and the European

Parliament.

-

- I know that the ECSA membership will support me in my

challenging task.

-

- Philippe Louis-Dreyfus

EUROPEAN SHIPPING IN A GLOBAL MARKET

- Economic and trade developments show progress

-

- The year 2006 again showed a healthy expansion of world trade in

real terms and in dollar value by 15% to $11.76 trillion. Global GDP

accelerated by 3.7%. The on average high oil prices well into 2007

have not had a serious impact on merchandise trade or on inflation.

To a large extent this can be attributed to the shift of production

to very competitive manufacturers in Asia, while at least in the EU

the oil consumption remained stable or even decreased. According to

a WTO report a large part of the trade acceleration can be

attributed to the marked recovery in Europe’s external trade.

-

- Although the US trade deficit continued to grow, the US

merchandise export growth expanded faster than imports for the first

time in a decade. China’s merchandise exports again increased

at a staggering level of 27% and second half 2006 exceeded US

overall exports for the first time, while India also showed an

outstanding economic and trade growth.

-

- Shipping developments very positive

-

- As a result, maritime transport as main transport mode in

international trade showed in 2006 an overall increase of 5.5% in

tonne-miles. The dry bulk sector performed particularly well

throughout the year while the oil tanker trade was still good, but

subject to more volatile market conditions. LNG trades went up by

another 12% and the fleet expanded to 225 units (139 end 2005) with

141 more units on order. Car carriers enjoy high demand while

conventional and specialised vessels continue to perform well in

their particular markets. The much published and feared threat of

overcapacity by massive new container vessel newbuildings was

absorbed by another strong growth in world container trades by 10.4%

to 129 million full TEU.The Far East – north Europe /

Mediterranean trade was particularly strong with a 16.9% increase

and continued well into first half 2007.World ports handled 426

million TEU, including transhipments and empties.

-

- Outlook encouraging

-

- Although mostly more positive provisional data for first half

2007 may prove this wrong; a consensus among forecasters and the WTO

favours a moderate deceleration in world economic growth in 2007,

with a growth in GDP of close to 3% and an increase in global

merchandise trade slowing down to 6% as against 8% in 2006. The

outlook for demand for maritime transport is equally positive, but

high fuel costs, continuing imbalances especially in container

trades and on-land transport congestion may take their toll.

-

- * Detailed fleet and trade statistics will

be found in the statistics section

-

- EU/EEA SHIPPING

-

- Maintaining a strong share

-

- European shipping operating in global markets fared well as

described above. The EEA registered merchant fleet showed a 3%

increase in GT with a 1,6% increase in the number of vessels. The

EEA share against the World fleet reduced from 23,7 to 23%; the EU

registered share is 20%. However, looking at the EEA beneficially

controlled fleet, the very substantial share of over 41% is

maintained.

-

- European shipping continues to be a staunch contributor to

foreign exchange earnings. Based on EUROSTAT data the contribution

of EU maritime transport services to the current account balance of

payment is €13.6 billion - for comparison, the overall EU-27

BoP deriving from external trade for 2006 shows a deficit of €

-92 billion.

FUTURE MARITIME POLICY FOR THE UNION

- A unique consultation process

-

- ECSA very much appreciates the unique consultation process that

has been followed since the publication of the Green Paper on a

future maritime policy in June 2006. At its meeting on 23 November

2006 the ECSA Board had a constructive exchange of views with

Commissioner Joe Borg on the follow up to the Green Paper.

-

- The ECSA comments and suggestions to the Green Paper as well as

the replies to the questions raised in the consultation are evidence

of the benefit that ECSA sees in the initiative towards an

integrated maritime policy. ECSA reiterated that the five themes

brought forward in its submission of June 2005 should remain the

basic goals:

-

- Ensuring the potential for growth in Europe through adequate

transport capacity.

-

Ensuring a stable and competitive environment for EU shipping.

-

Keeping regulation global.

-

Supporting a positive development of shipping in the EU.

-

Taking an environmental approach with a global perspective.

- The indispensable role of maritime services for European and

global trade and for the daily life of European citizens should be a

fundamental premise in the search for the right balance between the

economic, social and environmental dimensions of sustainable

development.

-

- The global character of shipping services has to be taken into

account on all fronts, particularly with regard to the competitive

position of the European shipping industry, safety and environment

issues, and a policy for maintaining maritime know how in Europe.

-

- Ratification of international Conventions is a fundamental

element to protect the global environment and the people working on

ships, and at the same time the simplest way to avoid substandard

shipping. ECSA therefore suggests that the Commission and Member

States should play a more active role in the ratification of the

international Conventions in the EU as well as outside the EU. A

regular monitoring process on the ratification of the relevant IMO

Conventions by Member States at Transport Council meetings is

recommended. Ratification and application of international

conventions should also be part of the EU external relations policy.

-

- The Lisbon Policy aiming at making of Europe the most

competitive trading entity in the world, should be a constant theme

in the holistic approach towards a future European maritime policy.

-

- By its mere existence, the Green Paper has the benefit of

stressing the importance of the maritime industries for European and

global trade as well as underlining its global character. ECSA

strongly believes that the Green Paper should lead to an EU maritime

policy aiming at maintaining and enhancing in the EU the world’s

biggest maritime clusters. To achieve this ambitious goal, the

follow up to the Green Paper should not necessarily result in new

rules but rather in some principles to guide the policy in the

coming years.

-

- ECSA looks forward to the Commission Communication that will be

issued in October 2007. The industry hopes that the future maritime

policy will support a further growth of European shipping.

EUROPEAN PORTS POLICY

- EUROPEAN PORTS POLICY

-

- Expansion of Ports and Hinterland connections key

-

- ECSA appreciates the Commission’s initiative in launching

a consultation on an overall European Ports Policy. This is an

essential element of a European transport policy, especially taking

into account that 90 % of European trade is transported by sea. A

continuous improvement towards more efficient services is a key

element for the maritime services that Europe relies on.

-

- Throughout the process of discussions ECSA has reiterated that,

whilst we should get the best from existing capacity by increasing

efficiency, the priority item within a European Port Policy should

be the extension of port capacity and hinterland connections.

Otherwise maritime transport would not be able to contribute to the

building of a sustainable transport system at the growing pace which

is expected for it in the EU Transport Policy. In this context a

fair balance between environmental concerns, port development and

the wider economy has to be established.

-

- Ports are fundamental handover points within the supply chain.

Improving supply chains is one of the key elements of the Lisbon

Policy to make the European economy the best in the world. It would

be difficult to explain and to understand why one specific sector in

a maritime supply chain should be an exception to this policy.

-

- All port services should be involved in an ongoing approach

towards improvements. Safety is a key prerequisite - but the safety

argument should not be abused in order to maintain or to introduce

protectionist measures - a contestable safety risk assessment is

essential. Technical progress should be encouraged instead of being

opposed; qualification of all involved in port services is essential

but should not be abused with protectionist measures.

-

- ECSA shares the view expressed by the vast majority of

stakeholders that rather than introducing a new Directive “soft

law” should have the preference as a first step. The fact

remains that the Treaty and in particular the four freedoms and the

competition rules apply to port services. The European Commission is

the guardian of the Treaty and should ensure that it is properly

applied. A “soft law” framework could be helpful in this

respect.

-

- The shipping industry hopes that the above views will be

reflected in a Commission policy paper that will be issued in

October 2007.

-

- SHORT SEA SHIPPING

-

- Marco Polo

-

- In March 2007, the European Commission launched a first call

under the Marco Polo II Programme with proposals for projects to be

submitted by 6 July 2007.

-

- The Marco Polo II Programme, adopted in May 2006, will grant

Community financial assistance for start-up, catalyst or common

learning actions with an aim at reducing road congestion and

enhancing intermodal transport. In addition, the Marco Polo II

Programme will also grant Community funding to Motorways of the Sea

actions and Traffic Avoidance actions. Projects must relate to

Member States but may include neighbouring countries.

-

- The Marco Polo II Programme runs from 1 January 2007 to 31

December 2013 and has an overall budgetary envelope of € 400

million.

-

- TEN-T

-

- In November 2006, a Trans-European Transport Network Executive

Agency was set up in Brussels.

-

- The main tasks of the Agency include technical and financial

management of projects co-financed under the TEN-T budget,

management of Community funds available for the promotion of the

TEN-T and providing the Commission with expertise.

-

- Motorways of the Sea

-

- Mr Luis Francisco Valente de Oliveira, who held different

Ministerial functions in previous Portuguese Governments, was

appointed as European Coordinator for Motorways of the Sea (MoS).

-

- In April, a joint French-Spanish call for tender for Motorways

of the Sea projects was published. The two countries have worked

together to provide funding to maritime links between French and

Spanish ports at the Atlantic side.

-

- The objective of the initiative is to reduce the circulation on

the road network between Spain and France by 100 000 to 150 000

lorries annually, and shift them to maritime transport. To that end,

France has a budget of € 41 million whilst Spain plans a budget

of maximum of € 15 million for each Motorways of the Sea

project.

-

- The selected projects should, amongst others, improve existing

connections as well as create new shipping lines.

-

- In July 2007, the North Sea Motorways of the Sea Task Force

issued a joint call for the submission of project proposals allowing

consortia of at least ports and transport operators to develop

Motorways of the Sea connections starting in the North Sea region.

-

- The main focus of the call is related to an improvement and

development of sea transport based multimodal logistic chains and a

realisation of modal shift towards short sea shipping by

establishing appropriate infrastructure and facilities. This is very

much in line with project launched by the Baltic Sea MoS Task Force.

-

- The North Sea Task Force comprises Belgium, the Netherlands,

Germany, Denmark, Sweden, the United Kingdom and Norway.

-

- LOGISTICS

-

- In June 2006, the European Commission issued a Communication on

freight transport logistics, addressing areas of actions to improve

transport logistics. Actions included the establishment of Focal

Points to identify and solve bottlenecks hampering the development

of or promotion of freight transport logistics.

-

- The Commission is expected to issue a Communication in October

2007 including an action plan on logistics.

-

- In the meantime, the Commission has launched a consultation

process inviting stakeholders to identify a set of bottlenecks

hampering freight transport logistics. Some 500 bottlenecks have

been identified, comprising bottlenecks of an operational,

infrastructural or administrative nature.

-

- In June 2007, a first meeting of the Freight Transport Logistics

Focal Points was held to appoint coordinators for each individual

bottleneck so as to facilitate possible solutions.

-

- MARITIME INDUSTRIES FORUM (MIF)

-

- A cluster approach of the maritime industries

-

- The 13th plenary meeting of the Maritime Industries Forum took

place in Oslo on 5/6 October 2006. There were some 300 participants.

The occasion was marked by speeches from the Norwegian Prime

Minister and the Minister of Trade and Industry. For the Commission,

Vice President Günther Verheugen, Commissioner Joe Borg and DG

TREN Deputy Director General Zoltan Kazatsay participated.

-

- In view of the timing the main theme of the plenary meeting was

the Green Paper on a Future Maritime Policy. It allowed MIF

participants to have a first exchange of views on a holistic

maritime policy. Specific attention was drawn to the importance of

the European maritime clusters for the EU economy. It was stressed

that the future holistic policy should promote their further growth.

-

- On transport issues the MIF parties continued the constructive

and useful exchange of views. The MIF is pleased to see that a

solution for the 45 ft containers was found following its

suggestions. The Group Transport of the MIF submitted suggestions on

the bottleneck exercise on Freight Transport Logistics and will

contribute to the Communication on logistics that the Commission

will issue in October 2007. A submission was also made to the Green

Paper on a Future Maritime Policy stressing the necessity of

expansion of ports and hinterland connections and drawing attention

to the problems encountered in this respect.

-

- The next plenary meeting of the MIF will take place in Malta in

October 2008.

APPLICATION OF COMPETITION RULES

- Following discussions and consultation starting in 2003 the

Council of Economy Ministers agreed on 25 September 2006 with the

Commission proposal to repeal the block exemption for liner

conferences and to lift the exclusion of Commission implementing

powers for tramp shipping and cabotage.

-

- LINER SHIPPING

-

- As from 18 October 2008 the block exemption covered by Council

Regulation 4056/86 will be lifted. Consequently liner conferences

will be prohibited in EU trades.

-

The Commission will issue guidelines on the application of

Competition Rules on liner shipping prior to 18 October 2008.

- Following a submission by the European Liner Affairs Association

(ELAA) the Commission published an “Issues Paper”

covering the post Conference regime for consultation with

stakeholders. The aim of the paper was to create a basis for the

Guidelines covering information exchange between operators and

forecasting of supply and demand. ELAA is in further discussion with

the Commission in order to have clear and workable guidelines for

the future.

-

- The publication of draft Guidelines for a further consultation

round is expected in September 2007.

-

- TRAMP SHIPPING

-

- EC Competition Rules have always applied on tramp shipping;

however, the enforcement powers were with Member States.

-

As from 18 October 2006 the exclusion of tramp shipping and cabotage

from Regulation 1/2003 has been lifted giving also enforcement

powers to the Commission in addition to Member States.

- The Commission will also issue Guidelines on the application of

EU Competition Rules on tramp shipping together with the Guidelines

for liner shipping. Since tramp shipping is not comparable to liner

shipping and terra incognita for many, ECSA supplied the Commission

with quite some background information including a study made by

Clarkson, examples of pool agreements and responses to different

questions as brought forward.

-

- A consortium of consultants made a report for the Commission on

the tramp market covering economic facts and figures on the supply

and the demand side as well as a legal assessment of tramp shipping

versus EU Competition Rules.

-

- In general the consultants share the view that tramp shipping is

a global industry operating/bidding in a global market of ships and

cargoes. It was furthermore confirmed that shipping pools have

limited market shares and have not been in a position to be dominant

or to make abuse of their market position. The consultants stressed

that “ the evidence did not indicate that pools have

historically ever been able to use their joint resources and

combined market power to push prices up at any time in any segment

of the industry. Far from it.”

-

- On the legal side, it was felt that guidance would be helpful on

assessment of shipping pools under EC Competition Rules. Depending

on the qualification of shipping pools under these rules, an

assessment of shipping pools needs to be carried out either under

Article 81 (1) or Article 81 (3). Shipping pools could also qualify

for application of the specialisation Block Exemption Regulation. In

any event, if shipping pools would fall under Article 81 (3), the

consultants confirmed that shipping pools would meet the cumulative

requirements under this article and could therefore be maintained

under EC Competition Rules. Furthermore, it was felt that

specialised services could fall under the Liner Consortia

Regulation, provided that the scope thereof would be enlarged.

Finally, certain clauses in pool agreements, in particular non

competition clauses, termination clauses and lay up clauses, need

further examination under EC competition law (sic).

-

- Following the open and constructive exchange of views with the

Commission services, ECSA is confident that a realistic approach in

the Guidelines will confirm a good working market system.

SECURITY

- EU CUSTOMS CODE

-

- Industry advocates a workable system with added value for

security

-

- Discussions on security in the European Institutions still

concentrate on advance cargo declaration and the status of an

Authorised Economic Operator (AEO).

-

- The industry, including ECSA, has been involved in a number of

consultation meetings and industry comments. Key points are

clarification on who should file, particularly on the liability for

filing of NVOCCs/forwarders doing their own notifications and the

AEO status.

-

- Joint industry submissions have been made to the Commission and

Member States on the initiative of the World Shipping Council (WSC)

and ECSA. The contributions of industry aimed at having an efficient

security checking system avoiding thereby unnecessary bureaucracy.

-

- On 19 December 2006 Regulation 1875/2006 laying down provisions

for implementing the Customs Code (on security issues) was published

in the Official Journal. The Regulation will take effect on

01/01/2008 (AEO status) and on 01/07/09 (Advance Cargo Declaration).

-

- The exchange of views between the Commission, Member States and

industry on Guidelines on the interpretation of the Customs Code

Implementing Provisions is continuing. Hopefully this will result in

workable rules with the maximum effect on security. In this respect

it has to be reiterated that advance cargo declaration can only take

place in an efficient way and with added value for security if it is

done through an electronic exchange.

-

- EU DIRECTIVE 65/2005 AND REGULATION 725/2005

-

- EU Member States had to adapt laws, regulations and

administrative measures to comply with Directive 65/2005 on Port

Security (whole port area) by 15 June 2007. The Commission has

started discussions with Member States and stakeholders on best

practice application of the Directive as well as of Regulation

725/2005 applying the ISPS code on ship and immediate ship/port

interface security. The Commission Joint Research Centre (JRC) is

assisting the Commission and Member States in this respect. Results

and possible suggestions are expected second half 2008. ECSA is

involved in the exercise with other EU stakeholders.

-

- US

-

- 100% Scanning unworkable

-

- Developments on security measures in the US are closely followed

in cooperation with the World Shipping Council. Stakeholders and the

European Commission have expressed strong concerns about the

possible introduction, by the US, of the requirement of 100 %

scanning of containers. The industry hopes that such an unworkable

intention will be withdrawn. The present system of advance cargo

declaration linked to intelligence gives a sound basis for proper

action on security.

SAFETY

- MARITIME SAFETY PACKAGE III

-

- Progress on safety related proposals

-

- In June Member States reached political agreement on three out

of the seven proposals of the 2005 Third Maritime Safety Package;

notably, on a proposed amending Directive establishing a Community

vessel traffic monitoring and information system, on a proposal for

a Directive on Port State Control (PSC) and on a proposal for a

Directive establishing fundamental principles governing the

investigation of accidents in the maritime transport sector. This

followed the adoption of the first reading reports on all seven

proposals by the European Parliament some months earlier.

-

- On the Community vessel traffic monitoring and information

system Directive, the Council proposed to establish specific

measures to enhance maritime safety in case of ice conditions, to

establish the rules for the acceptance or refusal of ships in need

of assistance in places of refuge and to enhance ship monitoring

through the SafeSeaNet information exchange system. The issue of the

independence of the authority designating the place of refuge has

proved the most controversial point; ECSA has continued to press for

the need for independent decision making in this regard.

-

- On Port State Control, the Council agreed with the establishment

of a new inspection regime to ensure better and more targeted

inspections by Member States, particularly with regard to

substandard vessels, whilst alleviating checks on quality vessels.

Substandard ships will be, amongst others, evaluated in relation to

the Flag State and access to Member States' ports may be

indefinitely refused. The developments in the Paris Memorandum on

PSC are reflected in the EU context, an approach welcomed by ECSA.

-

- The proposed Directive on Accident Investigation establishes

guidelines on technical investigations to be carried out following

maritime casualties and incidents. The Council accepted mandatory

investigations only in very serious cases, and the investigative

body will decide whether or not a safety investigation of other

marine casualty or incidents will be undertaken; the seriousness of

the casualty or incident and the possible lessons to be learned will

be taken into account.

-

- Following formal adoption of its “Common Positions”,

the Council will forward them to the European Parliament for a

Second Reading in the framework of the Co-Decision procedure.

-

- Other Safety related proposals

-

- In March 2007, the European Parliament voted in Plenary on the

proposed Directive on Flag State Compliance, supporting the

Commission’s proposal whilst providing Member States with more

flexibility as to how to implement IMO Conventions at national level

in line with IMO. For the time being, the Council has abstained from

discussing the proposal due to its controversial content in relation

to the perceived encroachment into national competence.

-

- In regard to the proposal relating tightening the rules on

Classification Societies, the European Parliament supported the

proposal for the establishment of an assessment committee to be

responsible for monitoring the work and the quality of

classification bodies.The EP also lowered the cumulated amount of

fines and penalties imposed on companies found guilty of

infringements to 5% of their total turnover. In relation to mutual

recognition, they strike a balance by stating that mutual

recognition should only take place in particular cases after the

development of demanding and rigorous models as a reference. A 3

year review on progress made is also advocated.

-

- Discussions in Council on the Commission’s proposals will

continue under the Portuguese Presidency and into 2008.

-

- EUROPEAN LONG RANGE IDENTIFICATION AND TRACKING

-

- In June 2007, the Council held a policy debate on the

establishment of a regional European Long Range Identification and

Tracking (LRIT) data centre, with broad support being expressed. It

requested the Commission to provide further detailed information on

technical, legal and financing issues, in order to take a firm EU

position prior to the meeting of the IMO Maritime Safety Committee

in October 2007.

-

- EUROPEAN MARITIME SAFETY AGENCY

-

- ECSA fully recognises the increasingly important role of EMSA in

the areas of maritime safety and the environment; notably, it

provides valuable technical support and advice to the European

Commission and Member States in a number of key safety areas, and

monitors the ways in which different Member States and organisations

are monitored. Its additional operational task in the field of oil

pollution response is equally significant.

-

- The fact that the ECSA Board visited EMSA in June 2007 is an

acknowledgment by European shipowners of its important contribution

to safer and cleaner waters and of ECSA’s commitment to

constructively working closely with EMSA in the future.

LEGAL ISSUES

- CIVIL LIABILITY AND FINANCIAL GUARANTEES FOR SHIPOWNERS

-

- An unnecessary and counterproductive proposal

-

- The controversial Commission proposal for a Directive on civil

liability and financial guarantees for shipowners was issued in

November 2005 as part of the Third Maritime Safety Package.

-

- The draft Directive aims at incorporating the 1996 version of

the international Convention on the Limitation of Liability for

Maritime Claims (1996 LLMC) into EC law and at introducing a regime

of compulsory financial guarantees for shipowners, evidenced by a

Member State certificate and notified when a ship is entering waters

falling under the jurisdiction of Member States. Furthermore, the

draft Directive aims at applying a more severe liability regime to

ships flying the flag of a state that is not party to the 1996 LLMC,

with “gross negligence” as conduct barring limitation.

-

- The draft Directive was discussed in the European Parliament and

an opinion was adopted in March 2007, supporting the Commission's

approach. In addition, the European Parliament called upon Member

States to ratify soonest the international Convention on Liability

and Compensation for Damage in Connection with the Carriage of

Hazardous and Noxious Substances by Sea (HNS), the international

Convention on Civil Liability for Bunker Oil Pollution Damage, 2001

(BOC) and the recently adopted international Convention on wreck

removal.

-

- The Council of Ministers has - time being - not yet started a

discussion on the draft Directive, mainly because of its

controversial content.

-

- ECSA supports a ratification and incorporation into EC law of

the 1996 LLMC and favours a regime of compulsory civil liability and

financial guarantees for shipowners but in line with applicable

international law. ECSA, however, strongly questions proposals such

as the obligation to evidence financial guarantees by means of a

Member State certificate and the deviation of the LLMC Convention

undermining the international regime on liability and

compensation.As the European Parliament, ECSA is a demanding party

for a prompt ratification of the international conventions on

hazardous and noxious spills (HNS) and on bunker oil spills (BOC).

-

- LIABILITY OF CARRIERS OF PASSENGERS BY SEA IN THE EVENT OF

ACCIDENTS (2002 ATHENS CONVENTION)

-

- The Commission proposal for a Regulation on the liability of

carriers of passengers by sea and inland waterways in the event of

accidents was issued in November 2005 as part of the Third Maritime

Safety Package.

-

- The draft Regulation lays down a Community regime of uniform

liability for the carriage of passengers by sea and inland waterways

and proposes to incorporate the provisions of the 2002 Athens

Convention relating to the carriage of passengers and their luggage

by sea into Community law. In addition, the draft Regulation also

aims at applying the Athens Convention to domestic carriage by sea

as well as to international and domestic carriage by inland

waterways. Furthermore, it is proposed to provide specific

compensation to disabled passengers in case of loss suffered to

their mobility or medical equipment and to pay a sum in advance in

the event of death of or personal injury to a passenger.

-

- The European Parliament discussed the Commission proposal and

adopted an opinion in April 2007, supporting the Commission's

approach with certain restrictions, in particular regarding the

scope of application of the draft Regulation and advance payment.

-

- Discussions have also started in the Council of Ministers with

two progress reports being adopted in December 2006 and June 2007.

Council discussions are concentrated on the same issues as in the

European Parliament, in particular the scope of application of the

draft Regulation and the incorporation of the IMO scheme on

carrier's liability for terrorist acts into Community law.

-

- ECSA supports a ratification of the 2002 Athens Protocol by

Member States and its incorporation into EC law but suggested some

improvements to the proposed Regulation, such as on advance payment.

-

- DIRECTIVE ON ENVIRONMENTAL LIABILITY FOR PREVENTING AND

REMEDYING ENVIRONMENTAL DAMAGE

-

- International Conventions to be ratified soonest

-

- EU Member States were obliged to transpose Directive 2004/35/EC

of 21 April 2004 on environmental liability with regard to the

prevention and remedying of environmental damage into national law

by 30 April 2007.

However, only few of them have done so within

the requested timeframe.-

- The Directive establishes a framework of environmental liability

based on the ‘polluter-pays' principle to prevent and remedy

environmental damage. Environmental damage includes damage to water

resources, natural habitats, animals and plants as well as

contamination of land which causes significant harm to human health.

-

- As regards shipping, the Directive provides that environmental

damage caused by incidents covered by the international Conventions

listed in Annex 4 is excluded provided that these conventions have

entered into force. Furthermore, the Directive is without prejudice

to the right of the operator to limit his liability in accordance

with national legislation implementing the Convention on Limitation

of Liability for Maritime Claims (LLMC), 1976, including any future

amendment to the Convention.

-

- In practice, oil spills are covered by the international

Convention on Civil Liability for Oil Pollution Damage, 1992 (CLC)

and the international Convention on the Establishment of an

International Fund for Compensation for Oil Pollution Damage, 1992

(IOPCF). Hazardous and noxious spills as well as bunker oil spills,

on the contrary, will fall within the scope of Directive 2004/35/EC

as long as the international Convention on Liability and

Compensation for Damage in Connection with the Carriage of Hazardous

and Noxious Substances by Sea, 1996 (HNS) and the international

Convention on Civil Liability for Bunker Oil Pollution Damage, 2001

(BOC) have not entered into force. ECSA together with the

International Chamber of Shipping (ICS) is urging Member States to

ratify these Conventions soonest.

ENVIRONMENT

- AIR EMISSIONS

-

- Global solutions necessary if regional solutions to be

avoided

-

- The reduction of air emissions from ships has become a major

focus of regulatory attention both in the international and European

context, and it will no doubt continue to be so in the coming

years.What is clear is that if significant measures are not taken

through IMO in the near future, the EU will come forward with

regional proposals. This would be very regrettable as it could well

lead to a myriad of different rules around the world, to the

detriment of the efficient ship operations, and the environment

generally.

-

- REVIEW OF MARPOL ANNEX VI

-

- In relation to Sulphur all the EU bodies - Member States,

Commission and European Parliament - are looking to the discussions

in IMO on the revision of MARPOL ANNEX VI to come forward with

measures to reduce air emissions by mid 2008.

-

- Specifically, the Council Conclusions of June 2007 sought

ambitious emission limits going significantly beyond current

regulations and requested the Government/industry IMO Scientific

Group established in July to consider, in a holistic approach, all

the options on the table and to take into account all the possible

side effects.

-

- The options include reducing the current sulphur limit in

Sulphur Emission Control Areas (SECAs) from the current 1.5%,

lowering the global cap, the creation of additional SECAs, the use

of distillate fuel over time, the use of distillate fuels in defined

coastal areas and the promotion of exhaust scrubbing technology.

This approach of seriously examining all the options in such a

manner is very much in line with the position taken both by ECSA and

its sister organisation in the global context, ICS.

-

- The Commission also wishes to see an international solution and

it could well be that they consider that, for the shorter term, a

reduction of the 1.5% in SECAs to at least 1%, together with the

possible creation of additional SECAs around the EU, would be a

minimum acceptable outcome. Anything less would certainly lead to

the EU coming forward with their own proposals, and there is a clear

mechanism for doing so as the 2005 Sulphur Directive is due for

review in 2008.

-

- The third player in Brussels is the European Parliament and they

are almost certain to wish to go further than the Commission or

Member States; as an indication, their Report for the Green Paper on

a future Maritime Policy refers to lowering the sulphur limit in

SECAs to 0.5%, to creation of Mediterranean and North East Atlantic

SECAs, Nox and Sulphur taxes, shore side electricity and

differentiated habour dues favouring vessels with low SOx and Nox

Emissions.

-

- The industry has advocated a goal based approach to emission

reductions whereby emission limits are set according to

environmental needs, thus leaving the market and technology to find

appropriate solutions. A single solution and its mandatory

application to all ships could only serve to stifle innovation;

rather, means to achieve and exceed limits can be found by

innovation and marketled solutions. What is vital is that any new

regulations result in an overall net environmental benefit and

ensure that solutions that may make a difference to the

environmental footprint of shipping do not have a disproportionate

and negative effect on the global environment.

-

- REDUCING CARBON EMISSIONS

-

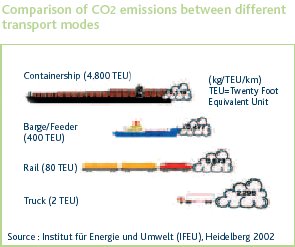

- In the climate change debate, shipping should be regarded as the

best available solution to the global need for transportation, it

being the most energy efficient form of transport and the backbone

of global trade - it produces less greenhouse gases per tonne

kilometre than any form of transport and carries some 90% of the

world's goods by volume. (See graph on the right). Seen in the light

of the enormous volume of goods carried by sea, the CO2 emissions

from shipping is small, various independent sources estimating that

it accounts for some 2% of global greenhouse gas emissions.The

reason for this is that for many decades shipping has had a strong

market driven incentive to focus on reduction of fuel consumption,

and the consistently high bunker prices will ensure that this will

continue.

-

- It is of course recognised that both in Europe and globally the

key political issue is for action on climate change and, in the

context of shipping, the industry is committed to playing its role

in taking action to reduce its CO2 emissions. The debate on the most

appropriate measures to

-

take in the maritime field is at a relatively early stage and ECSA

is actively involved in a holistic consideration of all alternative

options.

-

- While in the maritime context, Member States and the Commission,

as with ECSA, are also looking to IMO for global measures to the

global issue of climate change, the Commission will almost certainly

be pursuing EU initiatives in parallel. In particular, in early 2008

they will be undertaking a study on the options they consider most

promising to reduce emissions. These are likely to include CO2

indexing, differentiated harbour dues, and emission trading.

Moreover, it could well be that shipping (as with aviation) will be

included in the European Emission Trading Scheme at some stage, and

ECSA will be analysing the practical possibilities in cooperation

with the Commission.

-

- SHIP RECYCLING

-

- In May, the Commission published a Green Paper on Ship Recycling

as part of its goal of developing an EU strategy on the issue, with

a number of options being put forward for the consideration of

stakeholders. The shipping industry will be responding in detail to

the paper.

-

- The industry, coordinated and led by the ICS, has long been

involved in the international efforts to achieve the much needed

improvement in the working and environmental standards in many of

the recycling yards, mostly located in Asia. In particular, it is

closely involved in the development of the new IMO Convention on

Ship Recycling which addresses such legitimate concerns and which it

is anticipated will be adopted in 2009. It is encouraging that the

Commission acknowledges in the Green Paper that it is the adoption

of this Convention which will have the single most beneficial impact

on the problem and it is hoped that EU Member States, together with

the Commission, will use their considerable political influence to

ensure the timely adoption of the Convention.

-

- It is recognised, however, that it will inevitably be some years

before the Convention enters into force and the industry has

consequently recently developed interim measures that should be

taken by shipowners intending to sell ships for recycling. These

involve, in particular, encouraging owners to select only those

yards which have stated they are willing to undertake operations

compatible with the measures, notably in relation to having ship

recycling plans and to conducting gas-freeing in their operation.

The measures inter alia also encourage shipowners to complete an

inventory of hazardous materials and to inform their Flag

Administration of the steps taken in accordance with the

recommendations. Detailed guidance material is being developed to

provide practical advice in relation to the interim measures.

-

- ECSA has also advocated that the political/economic position of

the EU and Commission is such that the priority action at the EU

level should be conclusion of cooperation agreements/development aid

arrangements with the countries concerned; through such mechanisms,

financial and technical assistance can be provided to ensure that,

in practical terms, the working and environmental standards are

improved.

THE HUMAN ELEMENT

- IMPLEMENTATION OF THE 2006 MARITIME LABOUR CONVENTION IN THE

EU

-

- A unique Convention to be ratified soonest

-

- Bringing together and updating more than 60 ILO instruments, the

MLC uniquely covers on a global basis such areas as conditions of

employment, working hours, accommodation, medical treatment, minimum

age and recruitment. It is widely regarded as the ‘fourth

pillar' of the international regulatory system following the SOLAS,

STCW and MARPOL Conventions.

-

- Initiated and fully supported by industry, the Convention now

requires ratification of 30 states representing 33% of world tonnage

for its entry into force. In the EU context, the Social Partners

(ECSA and the European Transport Federation) have jointly urged

Member States to ratify as soon as possible, and the Council

Decision of June encouraging them to do by 2010 is to be welcomed.

-

- In addition, at the time of adoption of the MLC, the Commission

has indicated its clear wish that the Convention should as far as

possible be transposed into EU law and invited ECSA and ETF to

negotiate a Social Partners Agreement to this end, to be applied via

a Council Directive. ECSA together with ETF has entered into such

negotiations and, since October 2006, has been heavily and

constructively involved in this process. In entering these talks,

ECSA has been anxious to stress in particular that the MLC involves

the establishment of global standards and that this should not be

undermined by any substantive additional elements being introduced

in the EU context.

-

- To date, good progress has been made in the negotiations and

ECSA is hopeful of a successful conclusion being reached by around

the end of 2007.

-

- DEVELOPING SKILLS AND MAINTAINING EMPLOYMENT IN THE MARITIME

INDUSTRIES

-

- ECSA fully recognises the importance of maintaining European

maritime know-how. Such expertise is relevant and crucial not only

for the shipping industry itself but for the entire maritime

clusters, which in turn are vital to the economic and social

interests of the Community. In this respect, it should be noted that

most European maritime jobs are ashore, such as in: maritime

administrations, ports, shipping offices, financial institutes,

shipbuilding, production and development of maritime equipment, etc.

Education and qualification should take the high quality

requirements ashore into account.

-

- The need to ensure that European shipping can continue to

effectively and fairly compete in the global market must always be

the cornerstone of the EU policy in this global labour market. Such

an approach is fully consistent with the EU Lisbon Agenda.

-

- Labour flexibility is a key element for shipping operating in a

global competitive environment with a global labour market for

seafarers. The alternative approach of promoting restrictive

measures in an attempt to preserve the jobs of European seafarers

would have the opposite effect to that intended. It would lead to

lack of competitiveness, loss of markets, a shrinking of EU fleets

and, inevitably, to loss of European jobs.

-

- European shipping companies should also continue to be able to

employ residents of other Member States reflecting the cost of

living, taxes etc. in that other Member State. It is moreover

important that European seafarers from Member States with lower

costs of living are not deprived of their right to compete within

the Community. This is a basic right for nationals of all EU Member

States.

-

- Many of the clusters have common concerns on skills. In some

cases these are shared with land based industries - for example, the

constant shortage of quality engineers. As with other parts of the

maritime clusters, shipping needs to highlight to young people

Europe's maritime heritage as well as the dynamic and forward

looking characteristics of today's shipping industry.

-

- Such challenges are being addressed, and a number of initiatives

have been taken and should be enhanced, consistent with Transport

Council Conclusions of December 2005 on maritime employment, such

as:

-

- Career planning in the maritime clusters: In this

context, the social partners - ECSA/ETF - Career Mapping project

should be helpful in demonstrating the possible career planning

opportunities for European seafarers in order to make shipping an

attractive career option. The concept should be promoted and used

nationally. However, ship operators should not be charged with the

full burden of training and the emphasis on shore-based

opportunities provides a strong argument for advancing to 100%

public funding of maritime training.

- A stable and competitive environment for EU Shipping: The

right approach should be to provide incentives through positive

measures for the employment of EU seafarers through the State Aid

Guidelines instead of imposing restrictions to the employment of

non/EU personnel.

- National Action Promoting a Seafaring Career: In

different Member States promotion actions for a seafaring career

have been launched. The results are there: in many Member States the

number of candidates for the Maritime Academies have increased. This

is particularly so in countries where the national merchant fleet

has grown through a flexible application of the State Aid

Guidelines.

There is also scope for EU action. Further improving

the awareness and the perception of shipping by appropriate

campaigns, for instance by organising a European maritime Day, is an

integral part of this process.

MARITIME EXTERNAL RELATIONS

- What is good for international trade is good for shipping

-

- Operating in global markets means being dependent on

developments in international trade, third countries' policies and

operating conditions, a reason enough for closely following and

where possible supporting trade negotiations by the EU in the WTO

and on bilateral basis with third countries and regions.

-

- WTO-DDA

-

- The WTO negotiations as launched in November 2001 under the

heading of the Doha Development Agenda should have been finalised

end 2006. Maybe no-one expected this time-span to be realistic, but

the suspension of the Round in July 2006 was certainly a

disappointment to many who saw not only a potential for an increase

in Global trade, but also the need for new rules adapted to changing

balances in World trade. After a sparkle of new ambition in

November, a global business coalition called for unison and

emphasized that failure was not an option. While the benefits for an

ambitious conclusion of the Round are great, a failed Round could

lead to challenges to the WTO and a strong multilateral rules-based

trade system; to increased regionalism and protectionism.

-

- The G-4 Ministers (EU, US, India, Brazil) play a central role

and repeatedly have stated their commitment to finding solutions,

particularly on agriculture access and subsidies, for tariffs for

manufactured goods, all proving to be the main stumbling blocks.

Various high level meetings took place around the world and repeated

and sometimes rather dramatic calls have been made to resume the

negotiations, regrettably without a necessary breakthrough.

-

- A NEW EU TRADE POLICY

-

- Although a new WTO agreement remains the priority, the European

Commission launched consultations with EU stakeholders in external

trade and in early 2007 came out with a report and recommendations

for a new EU trade policy. In a pragmatic approach, the Commission

recognised that regulatory restrictions “behind the border”

have become increasingly important in determining the access to

market. The new approach includes a much enhanced cooperation

between Commission, Member States and business, also delegating more

initiative to EU Market Access Teams in the third countries

concerned. Also mentioned is the demand for a better involvement by

industry in the negotiation process with third countries.

-

- Having focussed much on the WTO negotiations, the EU risked

being bypassed by many other countries in concluding free trade and

regional agreements, setting EU trade interests at a disadvantage.

Therefore, a new trade policy with parallel approaches is very

welcome.

-

- FREE TRADE AGREEMENTS

-

- Negotiations on Free Trade Agreements have been launched first

half 2007 with South Korea, India, the ASEAN, as well as on

revisions of the Association Agreements with the ANDEAN and Central

America. This is an ambitious and challenging task in which ECSA

intends to offer maximum support by offering local knowledge and

also identify obstacles to national treatment and efficient maritime

transport services by EU operators.

-

- BILATERAL RELATIONS AND INTERVENTIONS

-

- The bilateral maritime agreement with China and the related

annual implementation meetings continues to enhance mutual

understanding and benefits. Negotiations with India on a similar

bilateral maritime agreement started with much delay and are

demanding more time on the detail, despite high level commitment.

The delay is disappointing as, at least as a minimum, only a firm

commitment to the de-facto already liberal operating conditions is

sought.

-

- ECSA looks forward to the materialising of the new EU trade

policy as described and particularly also to the effective setting

up of locally based EU Market Access Teams between the EU

delegations, embassies and business representatives. In practice

ECSA and member companies have had positive experiences with

similar, ad-hoc, initiatives for solving issues. There are some

concerns though that the initiative will remain restricted to a too

small number of emerging economies only, while most EU Delegations

and in developing countries also Member States' embassies are not

well staffed for dealing with trade issues.

-

- In the meantime ECSA will continue to cooperate closely with the

Commission services and Member States on occurring problems and as

appropriate also address these directly with third country

authorities. The case has not yet presented itself, but ECSA

certainly intends, when necessary, to call on the European

authorities and the WTO for enforcing the standstill clause adopted

at the end of the Uruguay Round's maritime negotiations in 1996.

This clause binds all 150 WTO member countries.

INNOVATION BY RESEARCH AND DEVELOPMENT

- CONTINUING INNOVATION FOR COMPETITIVENESS

-

- Research & development stands as the basis for the

continuous innovation of products, services, whole sectors and

thereby the competitiveness of the economy as a whole. Reason enough

for the EU to have placed intensified R&D efforts high under the

Lisbon Strategy.

-

- As identified and reported before, the many maritime related

initiatives and projects at national and at EU level are not easy to

follow, especially not the outcomes, the effectiveness and direct

benefit to maritime transport. ECSA continues its efforts for

enhancing the transparency for its membership, also for a better

judgement on a beneficial engagement in R&D.

-

- Meanwhile, respecting the responsibilities and competitive edges

of individual companies, the benefit of addressing R&D in a

broad maritime cluster approach has been recognised. In this context

the Maritime Industries Forum's R&D group transformed in the

Technology Platform Waterborne, with support of Commission and

Member States is aimed at further focussing of common interests in

innovation. It was gratifying to note that much of the content and

priorities were taken over in the December 2006 launched 7th R&D

Framework Programme.

-

- The Commission sponsored four year Flagship project on safe

maritime operations - with ECSA as coordinator - effectively started

in January 2007, bringing together 49 partners from shipping

companies and associations, shipyards, equipment manufacturers,

classification societies, research institutes and universities.

INTERNAL MARKET ISSUES

- ENLARGEMENT

-

- On 1 January 2007 Bulgaria and Romania became members of the

European Union and completed the sixth enlargement, increasing the

EU membership to 27 Member States. Two new Commissioners have been

appointed, Mrs Meglena Kuneva (Bulgaria) and Mr Leonard Orban

(Romania) for the portfolios of Consumer Protection and

Multilingualism respectively. The mandate of the two new

Commissioners will expire at the same time as that of all other

Commissioners, i.e. 31 October 2009.

-

- On 8 November 2006 a Commission progress report was published on

Turkey and all the other candidate and potential candidate

countries. One of the main stumbling blocks in the progress report

for Turkey remains the obligation to fully implement the Ankara

Protocol. In this context the boycott against Cyprus shipping should

be abolished, as requested repeatedly by the Commission and ECSA.

-

- As it stands Croatia will probably be the 28th EU Member State

as of 2010.Turkey and the Former Yugoslav Republic of Macedonia are

considered candidate countries with no specified timetable whereas

Albania, Bosnia Herzegovina, Montenegro and Serbia including Kosovo

are potential candidate countries where formal negotiations have not

begun.

-

- REFORM TREATY

-

- On 25th March 2007 the EU celebrated the 50th anniversary of the

Treaty of Rome at an informal Summit of Heads of State and

Government in Berlin. On that occasion the so called “Berlin

Declaration” was adopted. The declaration stated that “50

years after the signing of the Treaties of Rome, we are united in

our aim of placing the European Union on a renewed common basis

before the European Parliament elections in 2009”.

-

- A road map for a new treaty was presented at the EU Summit on

21-23 June 2007.

-

- The European Council agreed to replace the rejected European

Constitution by a Reform Treaty. A draft version of the Reform

Treaty is being prepared by an Intergovernmental Conference (IGC) in

line with the terms of the mandate agreed upon by the European

Council. The IGC should come forward with a draft Reform Treaty by

the end of 2007 allowing Member States to ratify the Treaty text

before the next elections of the European Parliament (June 2009).

-

- In general, the content of the Reform Treaty will be much in

line with that of the European Constitution, which was rejected

following referenda in France and theNetherlands in 2005.

-

- In short the Reform Treaty will include the following key

principles:

-

- The existing Treaties of the European Community and European

Union will not be repealed but will be modified by the Reform

Treaty.

- The current “pillar” system, consisting of the

Community Pillar and the Pillars relating to foreign affairs/defence

and to cooperation on justice/home affairs will be replaced by one

single European Union.

- The European Union will become a legal person.

- European legislation will continue to be based upon

“Regulations”, “Directives” or "Decisions".

- As of 1 November 2014, Council decisions will be adopted based

on double majority, representing 55% of the Member States and 65% of

the EU population. However, until 31 March 2017 a Member State may

still request that Council decisions are based on a qualified

majority.

- Decisions with regard to police and judiciary matters will be

taken on the basis of a qualified or double majority instead of

unanimity. However, the UK will opt out of criminal matters and

police co-operation.

- The six-month rotating Council Presidency regime will be

replaced by an EU President of the European Council, who will be

elected by the EU leaders for a two-and-ahalf-year term.

- A High Representative, assisted by a European External Action

Service with national and European diplomats, will permanently chair

ministerial meetings and serve as Vice-President of the European

Commission. He/She will combine the jobs of the current High

Representative and of the Commissioner of External Relations.

- As from 2014, the European Commission will no longer consist of

one Commissioner per Member State. Instead, the number of

Commissioners will be reduced to two-third of the number of Member

States. Commissioners will then be selected on the basis of a

rotation system and serve five-year terms.

- As of 2009, the European Parliament will consist of 750 Members.

- The Reform Treaty will include a cross-reference to the Charter

of Fundamental Rights making it thereby legally binding on European

legislation. However, the UK has opted out of the Charter and Poland

has made a unilateral declaration that the Charter will not affect

the right of Member States to legislate in certain fields, such as

family law.

ECSA SEMINAR ON EUROPEAN SHIPPING

- On 6 March 2007, ECSA organised a seminar in the Residence

Palace in Brussels, entitled “European Shipping a Global

Industry Serving European and Global Trade”.The seminar aimed

at explaining the global nature of shipping, including European

shipping, and its importance to global trade as well as to the

European economy.

-

- More than 160 people attended, including Vice

President/Transport Commissioner Jacques Barrot, the German

Presidency, Ministers and Secretaries of State from Member States,

the Commission services and many stake holders. The seminar was

considered a great success by ECSA President Mr Lennart Simonsson,

who moderated the debate, and by participants.

-

- All government speakers agreed that shipping is a global

industry, which requires a global regulatory framework through IMO

and ILO and not regional solutions. They also acknowledged the

importance of European shipping for global and European trade.

Furthermore, they expressed support for the Commission’s aim

of treating the oceans and seas in a holistic way in the context of

the Green Paper on a Future Maritime Policy for the EU.

EUROPEAN CRUISE COUNCIL STUDY & SEMINAR

- The ECC has since its inception in 2004 felt that the European

cruise sector can play a significant role in Europe but considered

that a comprehensive analysis of the contribution of cruise tourism

to Europe was first required. Undertaken by the ECC together with

Euroyards and the cruise port associations, the results were

published and launched at a Conference and Reception in February

2007. The following findings can be highlighted:

-

- The cruise industry’s direct expenditure in Europe is €8.3

billion and expected to increase to €12.7 billion by 2010.

-

Europe is the world leader in cruise ship construction and

refurbishment, with orders worth more than €18 billion up to

2010.

-

The cruise industry is major source of employment - up to a quarter

of a million by 2010.

-

Cruising is a major source of inbound tourism. Over 2.8 million

cruise passengers embarked on their cruises from European ports in

2005.

-

On average, passengers spent €100 each in every port visited on

their cruise during 2005.

-

European travel agents were paid an estimated €500 million in

commission from sales of cruises in 2005.

- While clearly a significant economic sector and a major direct

and indirect source of employment, it is notable that cruise lines

view Europe as the market that offers the greatest potential for

growth. It is in this context that the ECC has welcomed the

Commission’s intention through its Green Paper to develop an

integrated EU maritime policy. It is particularly encouraging that

at the heart of the initiative is a recognition of the importance

and potential of the EU maritime dimension and the need to promote

the growth of sustainable tourism as a major economic driver in

Europe.

PASSENGER RIGHTS

- Initiatives expected

-

- Over the last year, the Commission has been undertaking a

consultation exercise on the issue of maritime passenger rights in

relation to both the ferry and cruise sectors. This follows

legislation being enacted in other EU transport modes, notably

aviation. The passenger rights issues under consideration include

delays, cancellations, compensation, complaints procedures,

information to passengers and the rights of persons of reduced

mobility (PRM).

-

- Both ECSA and the ECC have made comprehensive written and oral

submissions and arranged for the Consultants/Commission to visit

cruise and ferry vessels in this context. A Commission paper is

expected in the autumn on what, if any, legislative or other

initiative is in their view required; further discussions between

the industry and Commission on the most appropriate way forward will

no doubt follow.

ECSA INTERNAL

- NEW PRESIDENCY

-

- The ECSA General Assembly held in Lisbon on 15 June appointed Mr

Philippe Louis-Dreyfus as the new President for a period of two

years, succeeding Mr Lennart Simonsson.

-

- Mr Philippe Louis-Dreyfus holds a masters’ degree in

economics and is the President of Louis Dreyfus Amateurs and

Managing Director of Louis Dreyfus S.A.S. He has other different

mandates, notably member of the supervisory board of Bureau Veritas,

director of the UK P&I Club, vice president of Armateurs de

France, director of the French Foreign Trade Council and director of

the French Business Confederation.

-

- The General Assembly also appointed Mr Marnix van Overklift,

Chairman of the Seatrade Group of companies, as Vice

President/President elect of ECSA for a period of two years.

-

- ECSA MEMBERSHIP

-

- ECSA welcomed the Bulgarian Shipowners Association as new ECSA

member at the ECSA June 2007 Board and General Assembly meetings in

Lisbon.

|